There is a classic tug of war going on between bitcoin buyers and sellers in the order books, Cointelegraph reports in an analysis. Will Bitcoin be able to stay above $63,000? A revival just before the halving is urgently needed.

Bitcoin liquidity

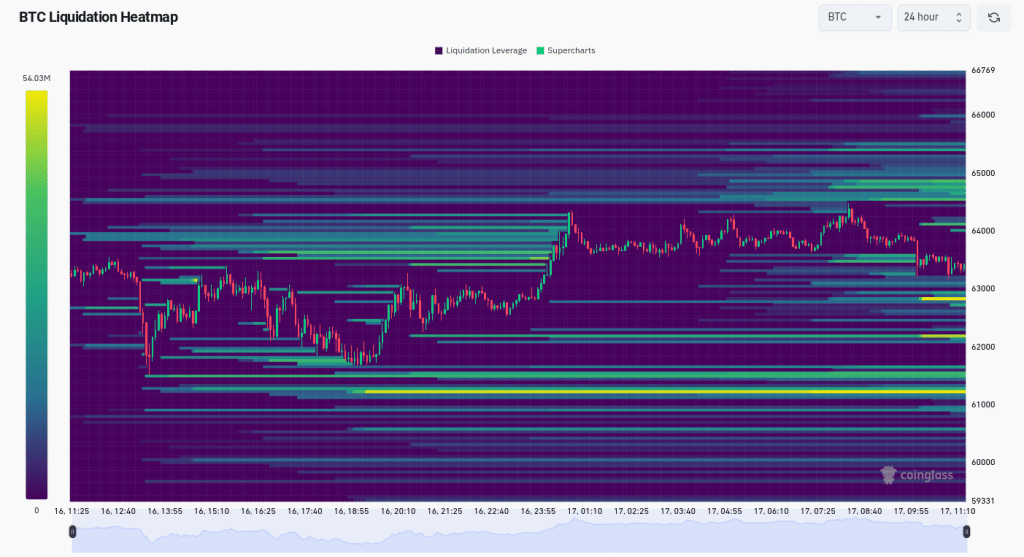

Data from analytics firm CoinGlass shows that a lot of buying volume has accumulated around $60,000 on this Wednesday. Earlier this week and last weekend, hundreds of millions of dollars in long positions were liquidated. Traders saw their money go up in smoke because they thought bitcoin would continue to rise. The bulls so far have the support at $61,000, but the price remains stuck at $63,000. The question is whether the recovery will continue towards $70,000 and above.

According to Keith Alan, co-founder of Material Indicators, this is ultimately “purifying” for a market that needs an upward leap. Once the bids start to pile up around the $61,000 – $63,000 levels, it usually precedes another run upward. He says, among other things: “What we ultimately want to see is more buying volume, so that the price has a better chance of breaking through the resistance levels.”

This is Why is Bitcoin Price is Falling! https://t.co/pz15E3Reg1

— Keith Alan (@KAProductions) April 16, 2024

According to CoinGlass, the largest concentrations of bids that have appeared in the 24 hours to press time are at $61,200, $62,200, and $62,800.

Bitcoin-financieringspercentage

The funding rate is a mechanism that helps align the price of the derivative contract with the underlying spot price of Bitcoin. The funding rate can be an indicator of market sentiment. A high positive funding rate may indicate predominantly bullish sentiment (many traders are going long), while a negative funding rate may indicate that more traders are bearish (going short).

There were even negative financing rates for the first time since October 2023. This means that the holders of shorts are paying the holders of longs. “If you look at the funding rates heatmap over the last 6 months, you can see how March was generally very overheated compared to the rest,” said popular trader Daan Crypto Trades on X.

Looking at the funding rate heatmap from the past 6 months, you can see how March was generally very overheated compared to the rest.

This is normal when prices are trading near new all time highs but also result in the occasional flush of leverage.

We just had such a flush. pic.twitter.com/9JE8aZ7ulv

— Daan Crypto Trades (@DaanCrypto) April 17, 2024

Trading suite Decentrader notes that the period of negative financing, while short-lived, is indicative of an overall market cooling. “Funding rates are positive again, but it was a sign that derivatives trading exuberance is declining,” the collective concluded on X.

#bitcoin funding rates finally flipped negative yesterday. pic.twitter.com/GWdi4VvMSN

— Decentrader (@decentrader) April 17, 2024

Source: https://bitcoinmagazine.nl/nieuws/bitcoin-kopers-verzamelen-zich-rond-61-000-nu-de-koers-weer-stijgt