As Bitcoin (BTC) has fallen below the $65,000 mark, and is currently trading at $64,886, there is a heightened sense of urgency among traders. However, is it time to panic or should you buy (not financial advice)?

Is there reason to panic?

This recent downturn reflects a broader trend seen over the past week, with Bitcoin losing around 2.4% of its value. There was a further decline of 1% in the last 24 hours alone, indicating increasing nervousness in the market.

Analysts at blockchain analytics platform Santiment highlight the ongoing downturn as a steepest three-day decline in active Bitcoin portfolios since the peak earlier in March, signaling a significant shift in investor behavior and market sentiment.

However, this is in stark contrast to ETH, as Ethereum portfolios continue to rise, indicating divergent investor confidence among the leading cryptocurrencies.

The increase in the number of Ethereum wallets indicates a bullish outlook for ETH, despite the bearish pressure on Bitcoin. Meanwhile, according to Bitfinex analysts, the ongoing sell-off has been significantly influenced by long-term Bitcoin holders and whales adjusting their positions during the market’s consolidation phase.

This behavior is typical of long-term investors who choose to reduce their positions during periods of market uncertainty to profit from or limit losses.

The report also reveals that the Hodler Net Position Change metric has consistently shown negative values, indicating that these major players are moving their holdings onto exchanges, possibly for sale, putting downward pressure on the Bitcoin price.

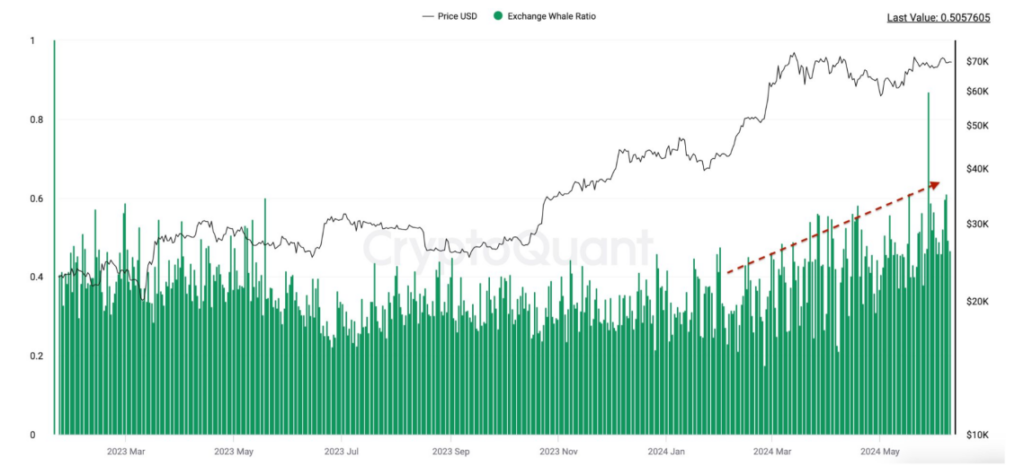

This trend is reflected by the rising Bitcoin Exchange Whale Ratio, which tracks large deposits on exchanges relative to overall market activity.

As more whales transfer their Bitcoin to cryptocurrency exchanges, the increased potential supply in the market could lead to price declines.

Is it time to buy?

Despite these pressures, some analysts remain cautiously optimistic about a possible recovery. CrediBULL Crypto, a leading analyst, suggested on He described it as follows:

“There is a chance that our $BTC bottom is in with this SFP. Below you can see what I’m looking at now.

Yes, technically we can still go lower into the “dream long” zone below, but as I’ve said before, I wouldn’t be surprised if that zone leads the way.

That said, don’t sell your wife and kids until AFTER we get our short-term momentum, not before. At this point we are just waiting for the final confirmation (impulse).”

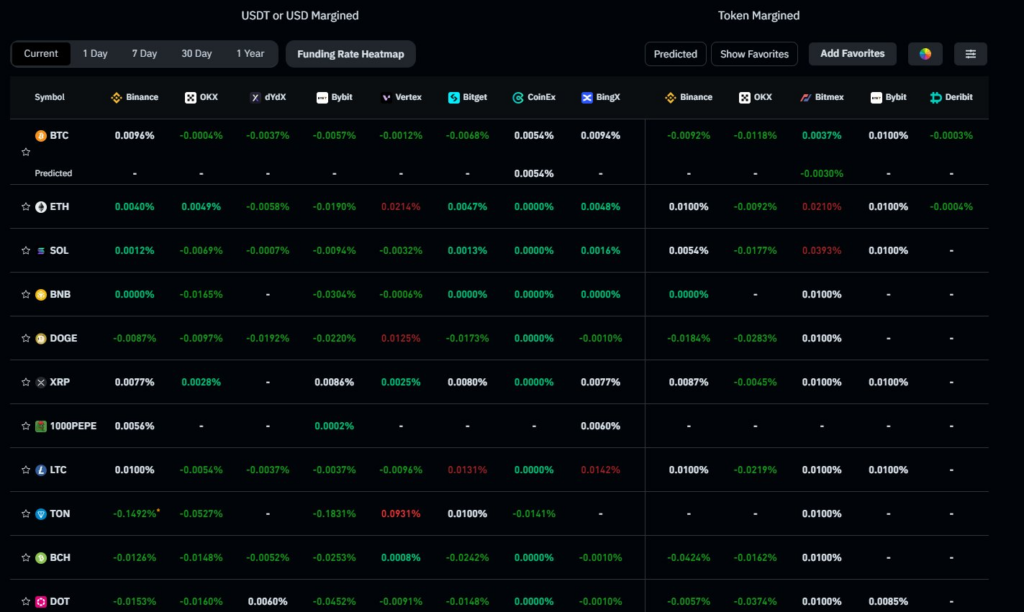

Funding rates in the crypto derivatives market serve as a critical indicator of traders’ sentiment. Recent data from CoinGlass indicates that funding rates are slightly positive, traditionally indicating a bullish outlook among traders.

In particular, positive funding rates imply that more traders are betting on a rise in the Bitcoin price and are willing to pay a premium to hold long positions in futures contracts. This measure can also often offset prevailing market sentiment, indicating that despite the sell-off, part of the market is preparing for a possible price increase.

Source: https://cryptobenelux.com/2024/06/19/bitcoin-daalt-onder-65-000-is-het-tijd-voor-paniek-of-zou-je-moeten-kopen/