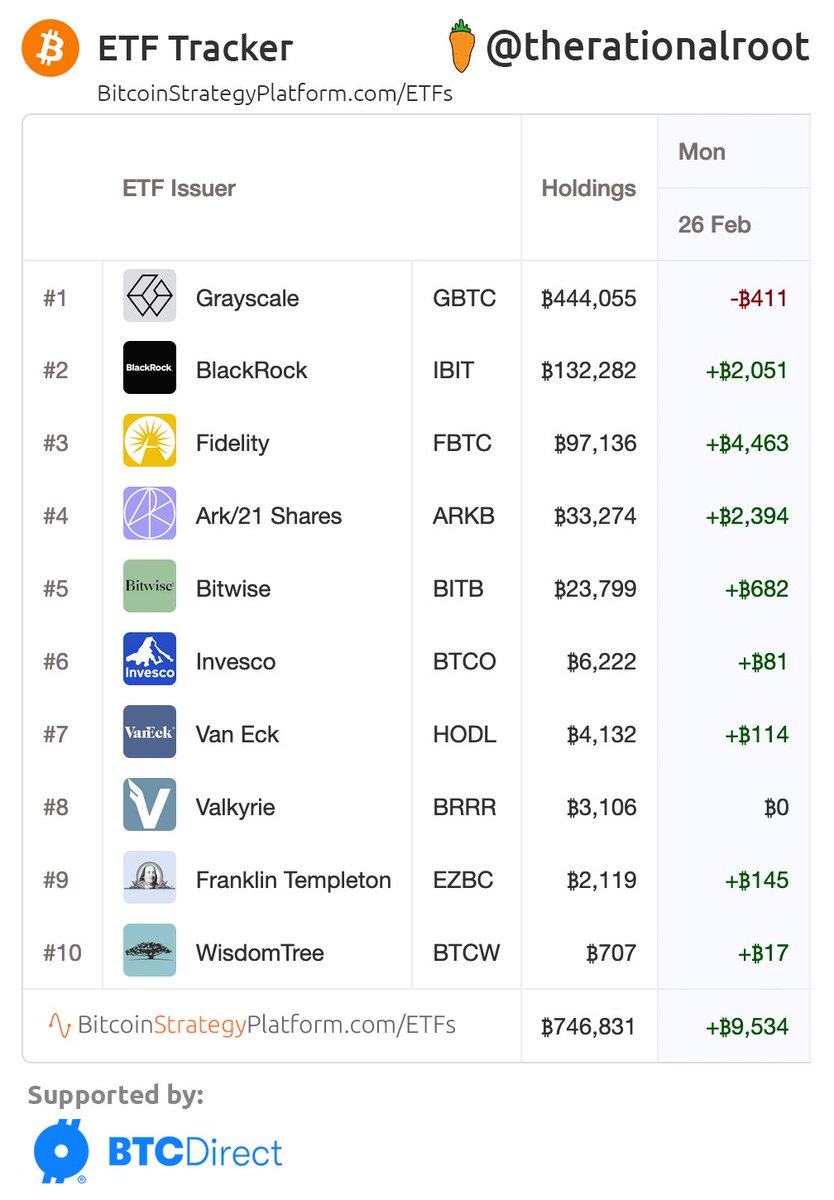

The Spot Bitcoin ETFs are slowly starting to notice how scarce bitcoin is. If we include Grayscale, the Spot Bitcoin ETFs have already collected 746,831 bitcoin since launch. On Monday, another 9,534 bitcoins were added. As a result of these enormous inflows, the bitcoin price is starting to rise, because demand is currently much greater than supply (scarcity).

The halving is coming

The scariest part is that the next halving is also scheduled for April. At the moment, the miners are still producing ~900 bitcoin every day. After the halving, production will increase to 450 bitcoin per day. That would mean that Monday’s net inflow of 9,534 bitcoin is about 20x higher than the miners’ daily production.

A Left Translated Cycle: previous Halvings aligned with the ETF approval instead of the upcoming halving. #Bitcoin pic.twitter.com/SbfHtSFSSK

— Root 🥕 (@therationalroot) February 26, 2024

Thanks to the Spot Bitcoin ETFs, Bitcoin currently appears to be entering a special cycle. Normally we only see new all-time highs for the bitcoin price a few months after the halving.

Now, in theory, that could happen before or around the halving. Especially if the bitcoin price continues as has been the case in recent weeks. In any case, the current cycle (red in the graph) is ahead of Bitcoin’s previous cycles.

Cost basis for short-term investors is increasing

Meanwhile, the cost basis of short-term investors is increasing considerably. The cost basis refers to the average purchase price of these investors with regard to bitcoin.

Short-term investors are people who have held their bitcoin for 155 days or less. Currently, the cost basis for this type of investor is $42,500.

Short-Term Holder cost basis at $42.5k and rising!#Bitcoin pic.twitter.com/N5F811PXmT

— Root 🥕 (@therationalroot) February 26, 2024

We often see that these prices act as strong support for the bitcoin price. Why? Because investors are not inclined to sell their bitcoin at a loss.

Once the bitcoin price approaches such levels, we often see the bears encounter more resistance. It is therefore a good sign for the bitcoin price that the cost basis of short-term investors is rising. Although that is also a natural consequence of rising prices.

Source: https://bitcoinmagazine.nl/nieuws/bitcoin-etfs-verzamelen-ruim-746-831-bitcoin