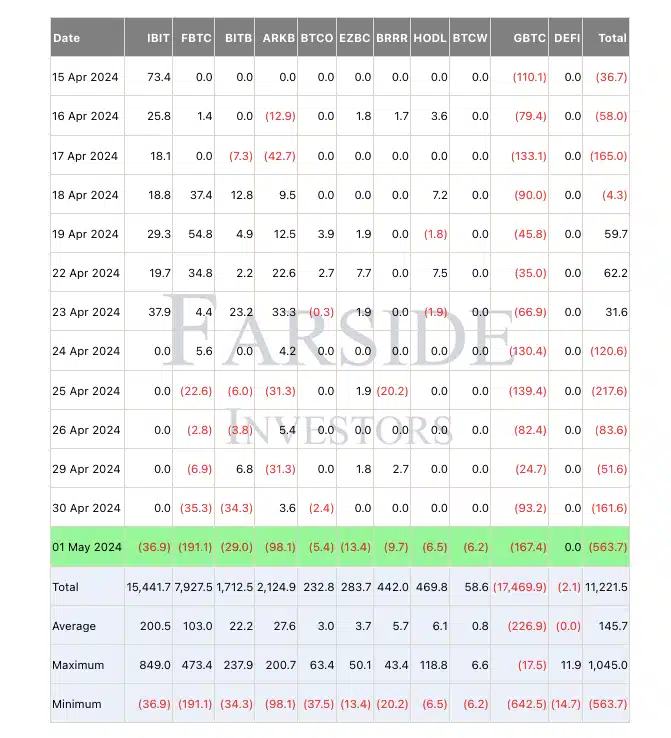

The price development of bitcoin seems to deter investors in the ETFs. Or vice versa. But in any case, while the price of bitcoin falls below $58,000, there is also a decline in new money invested in exchange traded funds.

Bitcoin futures weaken

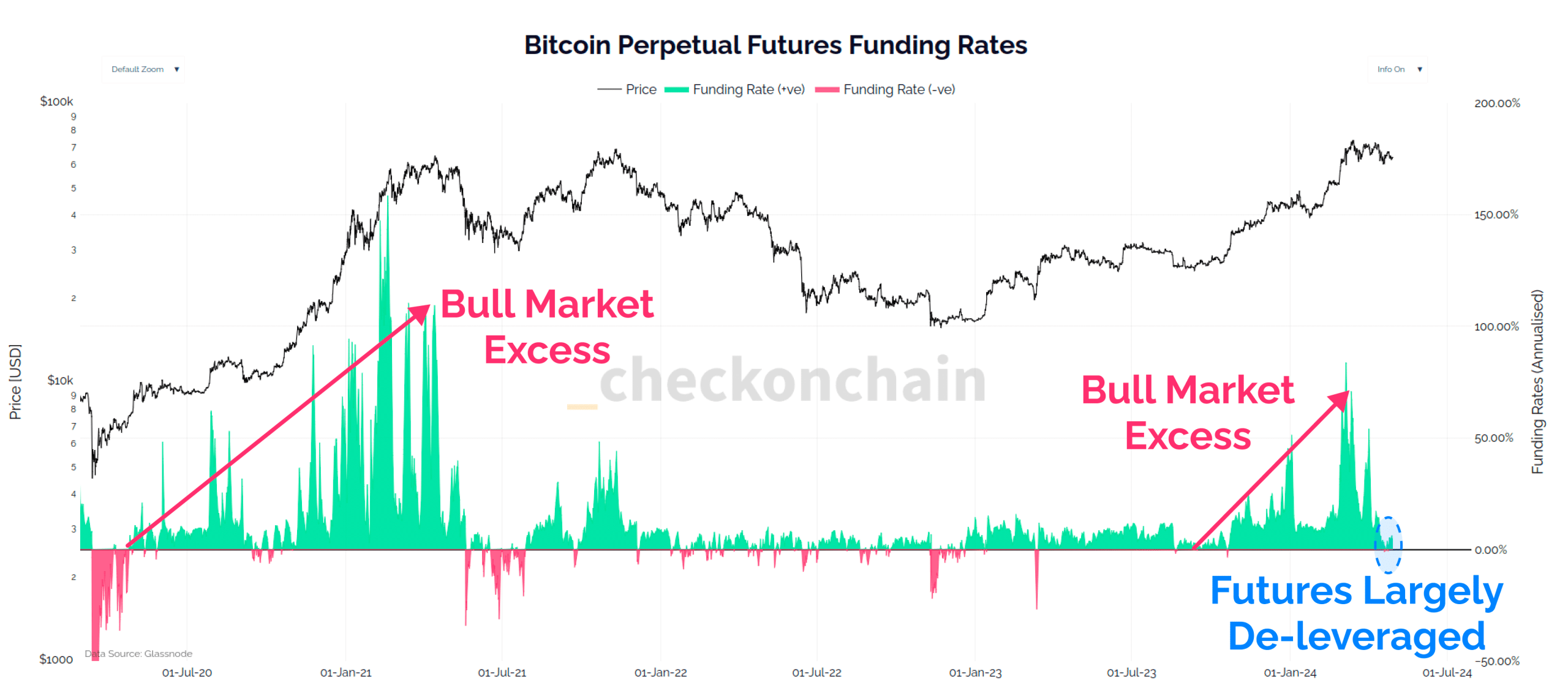

Bitcoin did not experience a “huge futures margin call” when its price fell yesterday. Yet it can be seen how the futures have deflated again and the leverage positions are back in balance. This seems to indicate a healthy correction in the price.

Yesterday the price fell to a (local) low of $56,500. As the above chart from Checkmate (using data from Glassnode) shows, there was a gradual “winding down” of bitcoin futures. According to him, this puts an end to the ‘bull market excess’.

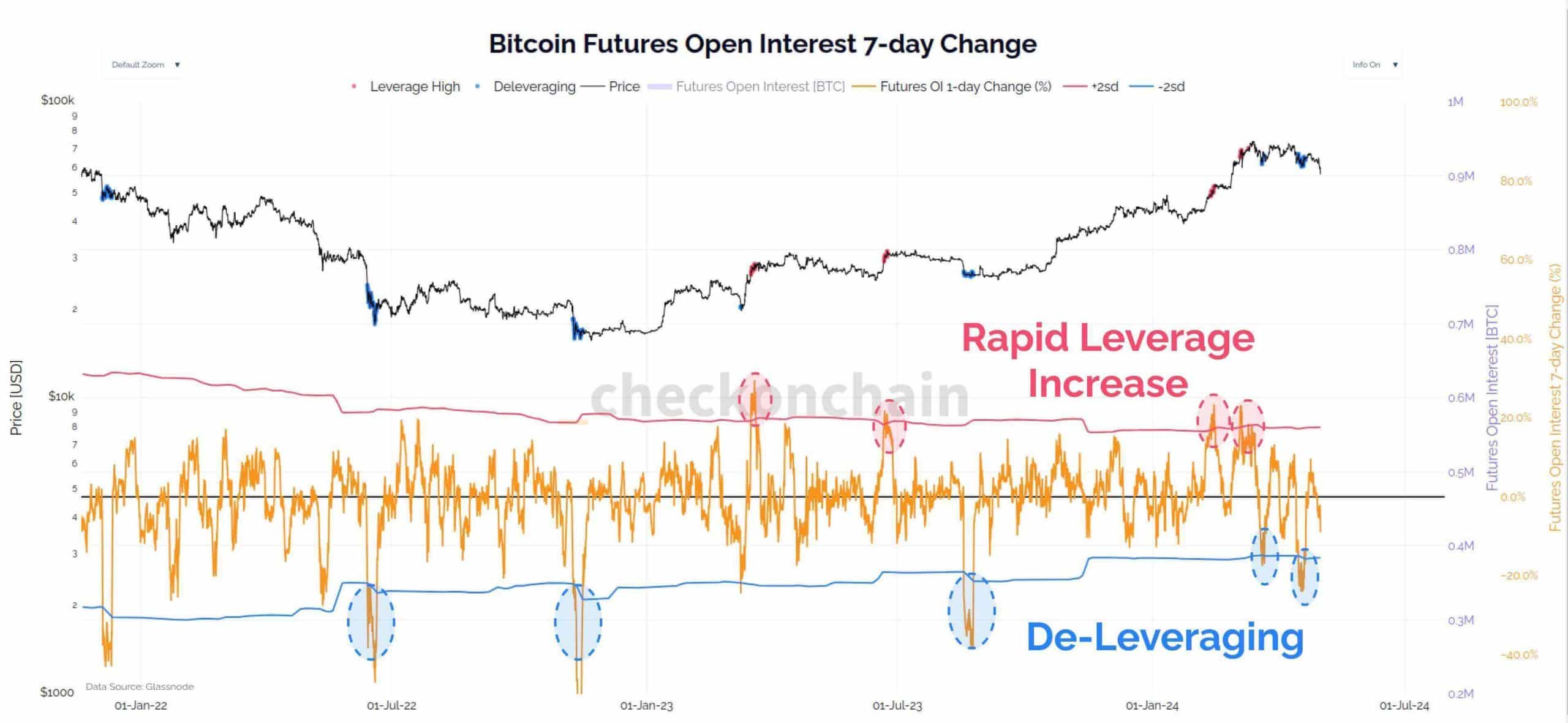

Leveraged positions allow investors to make larger profits (or losses) with the same investment. During the price peak around $73,000, the mania was greatest in that respect, as the graph below also shows. These two “overheated” points have now been negated, and have been replaced by periods of “de-leveraging”.

Meanwhile, US bitcoin exchange traded funds witnessed a net decline on May 1 outflow of more than half a billion dollars. Even BlackRock’s fund suffered a $40 million outflow, making it their worst day ever.

The biggest outflow came from the Fidelity Wise Origin Bitcoin Fund (FBTC): $191 million.

Source: https://bitcoinmagazine.nl/nieuws/bitcoin-daalt-onder-58-000-outflow-bitcoin-etfs-van-500-miljoen