Bitcoin (BTC) price action sees manipulative moves at the end of the month, with Bitcoin bulls failing to break a key resistance in time.

Bitcoin traded at $67,500 on June 1 after last-minute volatility in the BTC price cost bulls the chance at a crucial resistance reversal.

Bitcoin managed to maintain 11% monthly gains

Data from TradingView showed BTC/USD flat at the month-end after recovering from weekly lows. These followed concerns about a hack of a cryptocurrency exchange in Japan and “predatory” moves by traders as the month-end approached.

US macroeconomic data in the form of the Personal Consumption Expenditures (PCE) index failed to significantly improve sentiment despite narrowly beating expectations, showing inflation was slowing.

“The price has largely reversed pre-PCE price action, driven mainly by the unwinding into the event itself,” popular trader Skew wrote in an update on X (formerly Twitter) at the time:

“It is very important to see the developing market flows from here, especially spot flow – Spot bid + demand needed for higher. Lower could see some fomo hedges leading to a fall later.”

In the event, Bitcoin reversed around $66,650, setting a close that brought May’s monthly gains to 11%.

“Bitcoin is consolidating nicely here,” Michaël van de Poppe, founder and CEO of trading firm MNTrading, later summarizes:

“Markets are in balance and slowly waking up to further upside momentum. Crucial area to hold at $66K.”

“Games of the whales” form the BTC price

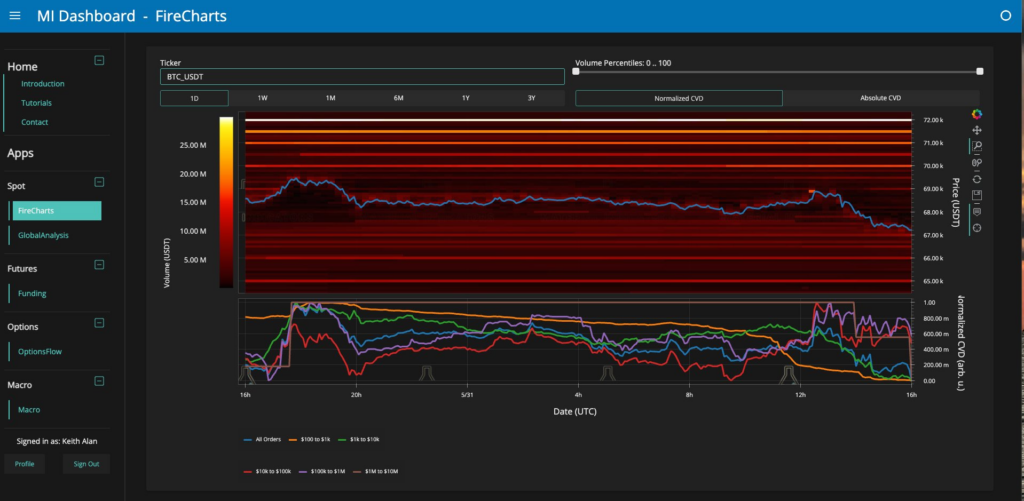

Providing further insight into the latest BTC price behavior, trading source Material Indicators clearly placed the blame for the volatility on Bitcoin whales.

High-volume traders played with liquidity at the end of the month, it noted, resulting in a failed attempt to flip $69,000 to support. Previously, Material Indicators co-founder Keith Alan said doing so in time would be an “epic” end to May.

“A whale dumped a block of Bitcoin demand liquidity into the market and knocked down a wick above $69k. Now the support at $67k is being exploited, and we have yet to see any new liquidity above $65k,” a post on

“The great shakeout continues.”

An accompanying chart showed the liquidity levels for the BTC/USDT pair on the largest global exchange Binance, along with volumes from various whale groups.

Alan described the movements as “games of the whales in action.”

Source: https://cryptobenelux.com/2024/06/01/bitcoin-beleeft-beste-mei-sinds-2019-ondanks-prijsdaling-van-3/