Source: https://cryptobenelux.com/2024/06/17/crypto-analyse-cruciale-fase-voor-bitcoin-en-altcoins/

In this weekly update we take a look at the current state of play for Bitcoin (BTC) and altcoins. While Bitcoin is at a key point and could potentially make an upward move, altcoins remain vulnerable. Let’s delve deeper into the details and the possible scenarios that could unfold.

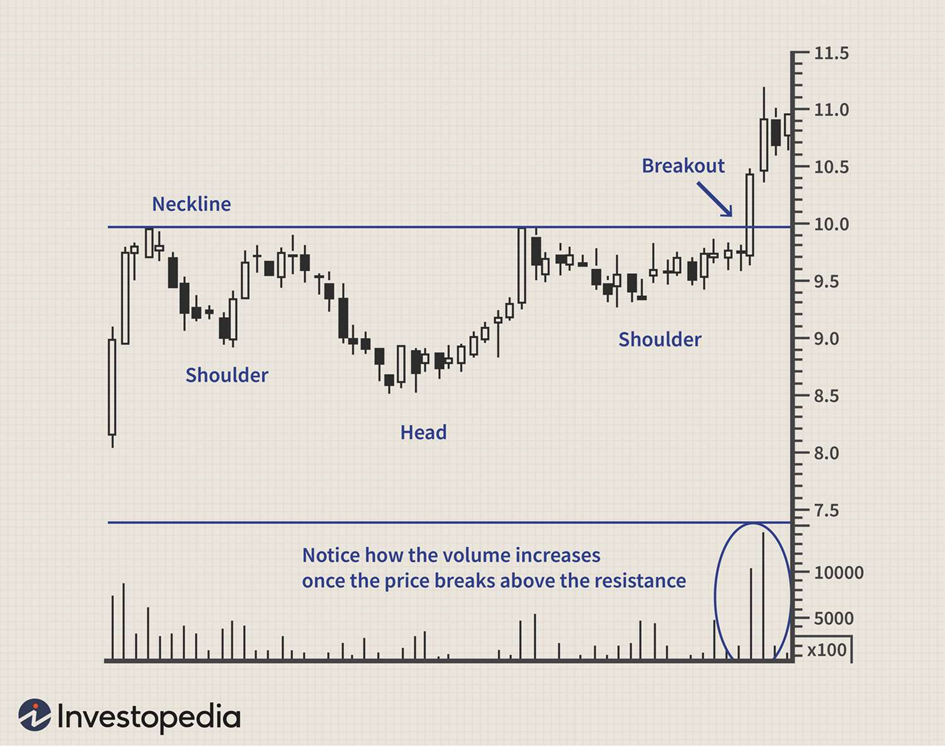

Bitcoin is currently closing its CME gap. This process could potentially result in the formation of a right shoulder, which could cause a push up. While this scenario is possible, I expect the rest of the week could still be tough for altcoins, especially if today is green and tomorrow is red. Altcoins are having a really hard time right now and I think this will continue until the ETH ETFs come into effect.

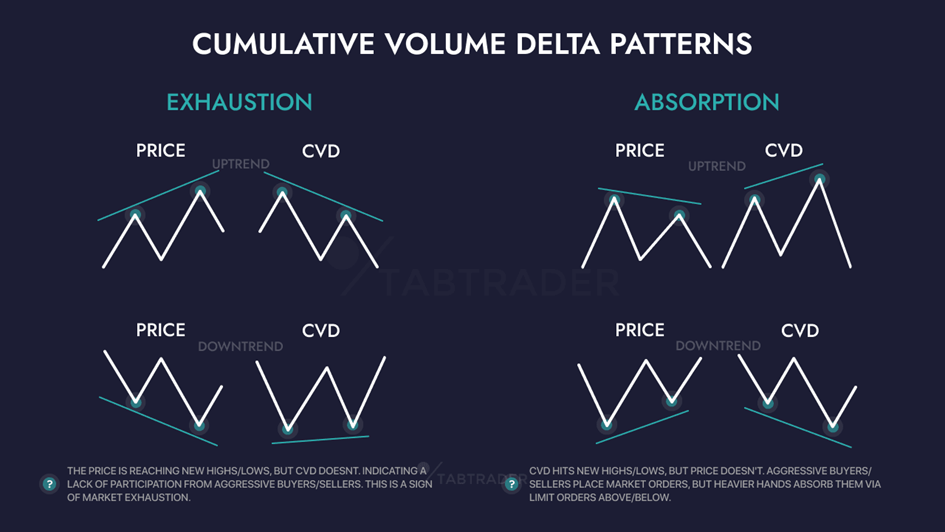

However, some absorption is visible in Bitcoin. This means that the SPOT CVD (Cumulative Volume Delta) goes down while the price remains higher. Absorption occurs when there are many sells, but the price is supported by strong buy orders (limit orders) that keep the price higher. This is often a sign of strength.

If Bitcoin holds this range, I expect we will remain in this range for a while. Should the range be lost, diagonal resistance and the weekly bull market support band at $63K and $61K provide a second level of support.

$OTHERS (crypto total market cap excl. top 10) looks weak at the moment. We are currently losing support and it looks like we are about to test horizontal resistance.

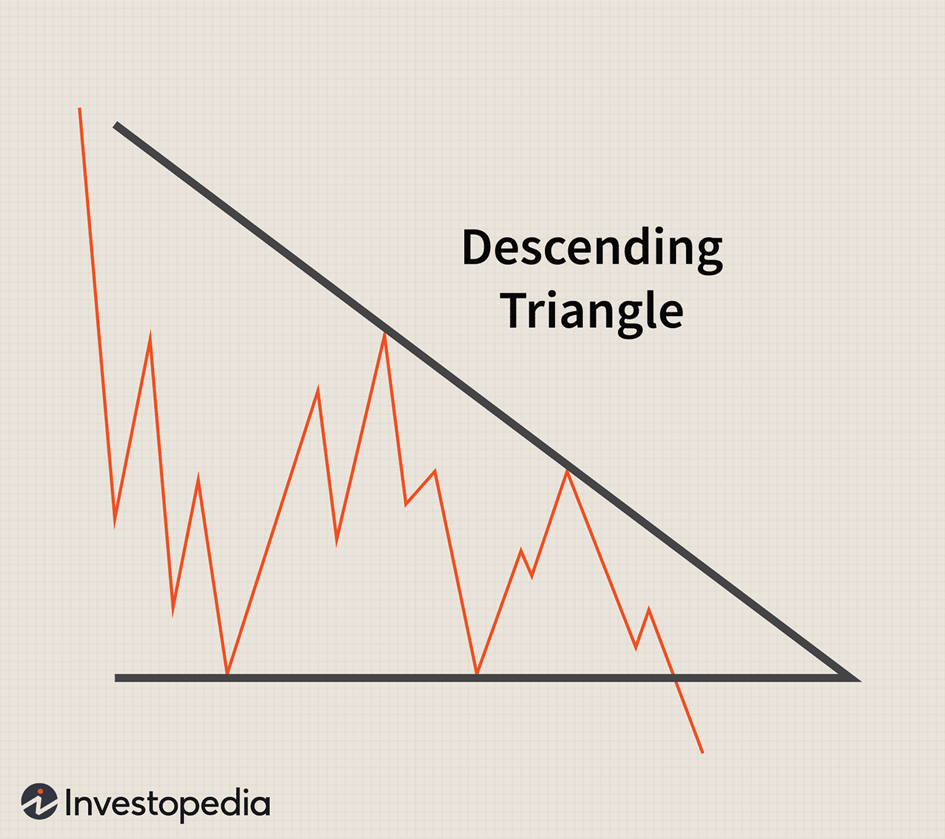

$TOTAL3 seems to form a descending triangle here. Although we closed above the bull market support band on the weekly, things are not looking good now. Once Bitcoin drops more, I think $TOTAL3 will lose support.

In summary, we are in a crucial phase. Bitcoin shows some strength with absorption, but must remain above current support to avoid further declines. Altcoins remain vulnerable, especially without clear bullish catalysts such as the adoption of the ETH ETFs. Maintaining current ranges is essential to avoid further weakness. The coming days will determine the direction of the market.

Disclaimer: The analyzes above are based on technical patterns and trends in the crypto market. It is critical to emphasize that this information is not intended as financial advice. Cryptocurrency investments inherently involve risk and are subject to volatility. Before making investment decisions, it is recommended to do your own research, seek financial advice and only invest what you can afford to lose.

Source: https://cryptobenelux.com/2024/06/17/crypto-analyse-cruciale-fase-voor-bitcoin-en-altcoins/