Ethereum’s price reached an impressive milestone today after passing $3,400. Here, the signs of consolidation are similar to Bitcoin, and ETH seems to be preparing for another bullish advance.

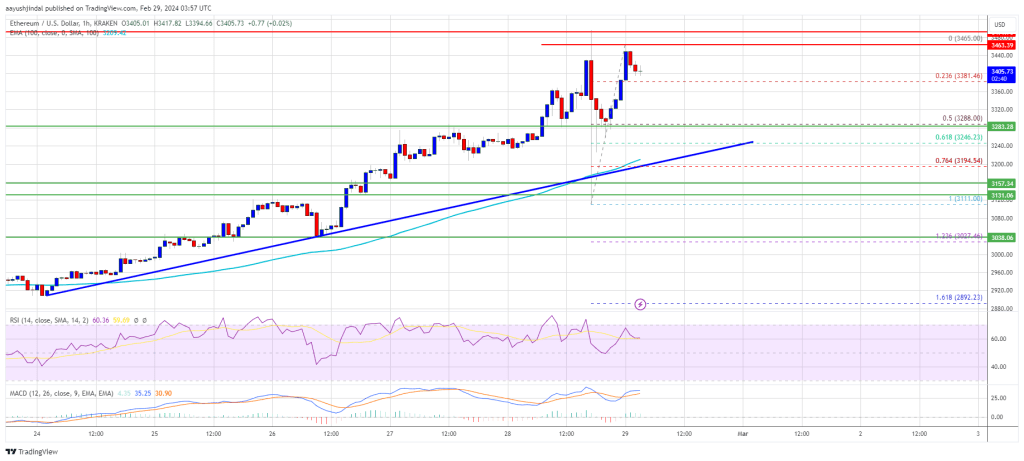

With the price trading comfortably above $3,350 and the 100-hour Simple Moving Average supported by an uptrend line at $3,250, everything points to strong momentum.

This momentum culminated on February 28, when Ethereum hit its highest point in more than two years at $3,488. Given these positive trends, how much can Ethereum become worth?

Ethereum Price Continues Strong Upward Movement

After overcoming the $3,000 threshold, Ethereum continues to perform strongly in a bullish market. This rise follows Bitcoin’s notable break above $60,000 on its way to $64,000. Not to be outdone, Ethereum has broken through the USD 3,320 resistance, leading to an increase of over 10% and even a test of the USD 3,500 level.

A new multi-month high has been established around $3,496, followed by a temporary pullback to $3,111. Ethereum is now targeting a recovery, trading above USD 3,350 and the 100-hour Simple Moving Average, with support at a crucial bullish trendline at USD 3,250.

The price now faces immediate resistance near $3,450, with key levels around $3,500 and $3,550 in sight. A win above $3,550 could give Ethereum significant bullish momentum, potentially leading to resistances at $3,680 and then $3,800, laying the groundwork for further growth.

Ethereum Traders See Funding Costs Rise to Peak in 2021

While the crypto market intensified its rally on February 28, with Bitcoin and Ethereum both hitting all-time highs, Ethereum came close to breaking the $3,500 resistance. Nevertheless, key indicators from the Ethereum derivatives market point to a potential risk for a pullback.

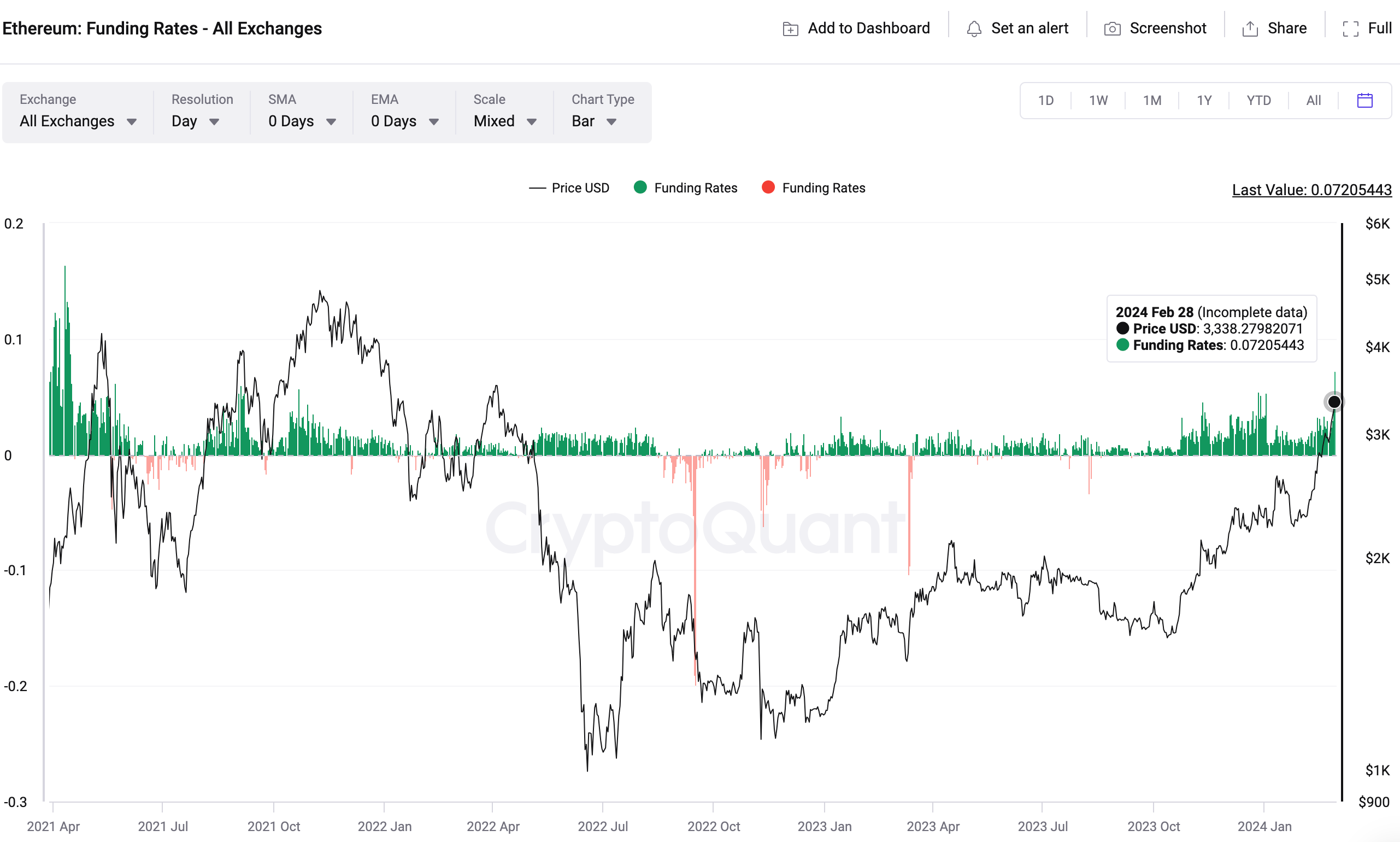

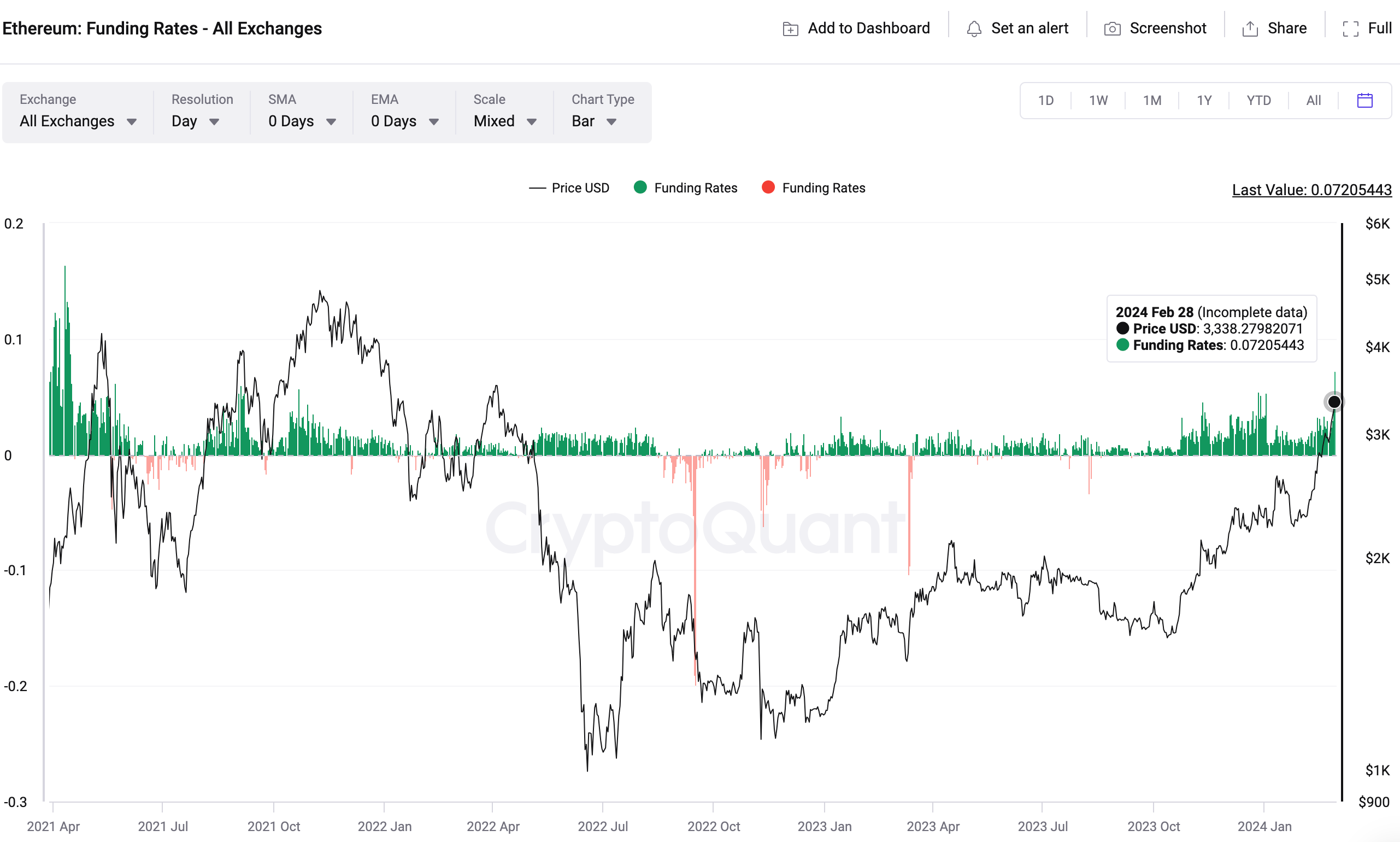

Funding costs, a measure that reflects the daily fees between active traders of perpetual futures contracts for a specific cryptocurrency, saw a notable increase on February 28, up as much as 0.07% within the daily time frame, the highest since April 2021.

This increase, about 40% higher than the 0.06% peak leading up to Ethereum’s all-time high of $4,800 in November 2021, suggests that traders are extremely bullish, but also that the market is overheating with heavily leveraged bullish bets.

These market dynamics can lead to a ‘long squeeze’, a phenomenon where sellers force to liquidate long positions, which amplifies the price decline and can cause significant losses for bullish traders.

How Much Can Ethereum Become Worth?

Amid the recent market heating, signified by the spike in funding costs on February 28, the Ethereum (ETH) price appears to be at risk of a possible pullback. Nevertheless, investor optimism, driven by anticipation of the Ethereum ETF ruling in May 2024, points to a strong support level above $3,000.

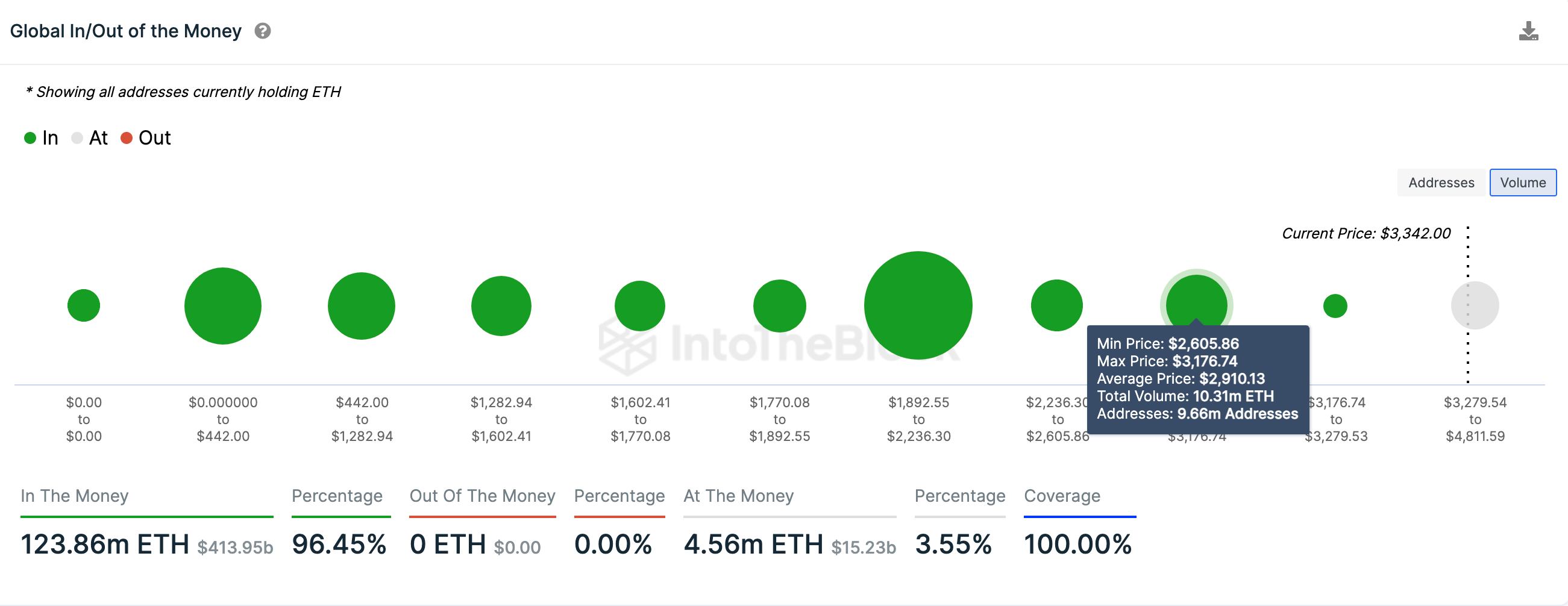

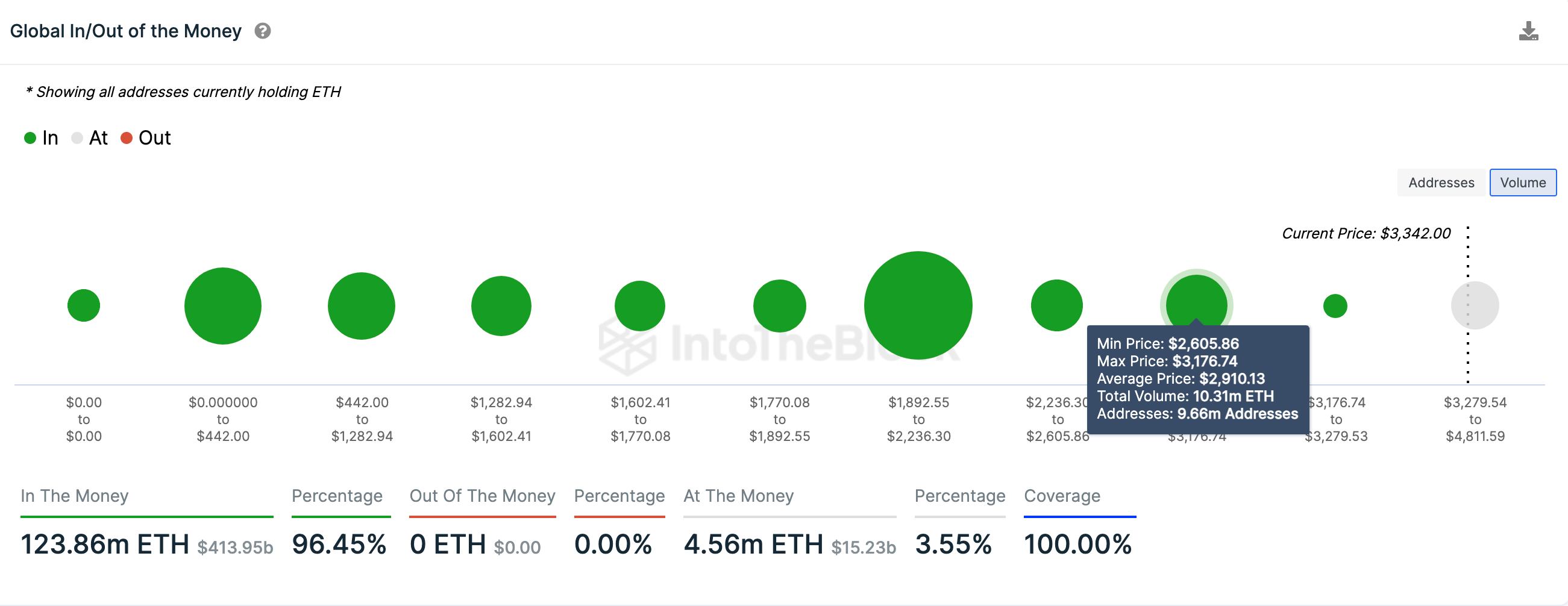

According to IntoTheBlock’s data, about 96% of current holders are in a profitable position with Ethereum currently trading around $3,340, reducing the chances of a quick downturn.

The support of 9.7 million addresses, holding 10.3 million ETH purchased around $3,176, promises a robust support line. If the price rises above $3,500 as predicted, Ethereum could soar to $4,000 by March 2024.

However, this scenario is complicated by significant selling pressure around the psychological resistance of $3,500, leaving the path to further appreciation a challenging proposition.

Besides Ethereum, there are also other emerging coins that are attracting attention in the crypto world. These new players, still in the presale phase, offer investors the opportunity to get in early and potentially benefit from their enormous growth potential in this market.

Bitcoin Minetrix (BTC.MTX)

Bitcoin Minetrix has introduced a revolutionary approach for crypto investors who want to profit from bitcoin mining without the need for proprietary mining hardware or extensive technical knowledge. This groundbreaking concept is made possible by their BTCMTX token, which runs on the Ethereum network.

A notable aspect of Bitcoin Minetrix is its ‘Stake-to-Mine’ mechanism. By staking BTCMTX tokens, users can earn additional tokens and mining credits. These credits represent tokenized mining rights and can be exchanged for free hashing power to mine bitcoin.

🔍 @Mawsoninc takes a strong stance on transparency, withholding 1.35 million RSUs from former CEO James Manning due to undisclosed transactions totaling $1.3 million.

Do you believe transparency is essential in corporate leadership?#BitcoinMinetrix also reaches another… pic.twitter.com/WGw8zaNUFZ

— Bitcoinminetrix (@bitcoinminetrix) February 26, 2024

Investing in BTCMTX, currently priced at $0.0137 per token, is seen as an opportunity to benefit from both the growth of this particular token and confidence in the future of bitcoin itself. This innovative model makes Bitcoin mining more accessible than ever, leading to Bitcoin Minetrix already raising over $11.4 million during its pre-sale.

Green Bitcoin (GBTC)

Green Bitcoin ($GBTC) represents an innovative fusion between Bitcoin’s heritage and Ethereum’s environmentally conscious blockchain, aiming to provide a sustainable staking model called “Gamified Green Staking”. This model encourages investors to contribute to a greener future while generating passive income. Off to an impressive start, $GBTC’s presale has already raised more than $1.2 million, indicating strong interest from the community and investors.

$GBTC is now available at an attractive price of $0.493, making it an excellent opportunity for early investors looking to contribute to and benefit from a more environmentally friendly crypto market. By participating in the presale via the official website, investors can not only invest in $GBTC, but also participate in a rewards system that provides additional tokens for staking and community involvement.

Green Bitcoin represents a sustainable investment opportunity with the potential for significant growth, especially given the upcoming Bitcoin halving. As a greener alternative in the crypto world, $GBTC embodies the opportunity to both invest environmentally and profit from the dynamic crypto market.

Disclaimer: This article contains insights from independent authors and is not part of the editorial content of BitcoinMagazine.nl. This is not investment advice, please do your own research.

Source: https://bitcoinmagazine.nl/nieuws/eth-schiet-34k-voorbij-hoeveel-kan-ethereum-waard-worden