Ethereum’s rise continues unabated, with the best-known altcoin recently reaching new highs and currently trading around $3,850.

This marks a break from the 61.8% Fibonacci retracement level, calculated from its all-time high, following a recent bearish push that tested the level as support.

At the same time, after a period of increased buying activity and bullish momentum, Ethereum has successfully recaptured a crucial resistance zone, namely the previous key yearly high of $3.6K.

This breakthrough, if confirmed by a retest, lays the groundwork for ETH to potentially establish a new all-time high. Will ETH rise to $4k?

Ethereum’s Upward Rally Overcomes Crucial Resistance

An in-depth analysis of Ethereum’s weekly chart reveals significant bullish sentiment, supported by a substantial and impulsive upward move that has broken the crucial resistance of the previous key yearly high of $3.6K.

This price action reflects strong interest from market participants in ETH, leading to increased demand. If Ethereum successfully retests at the broken level, the price is expected to continue its upward trajectory, aiming for the critical all-time high of $4,868.

Despite the bullish outlook, Ethereum may find significant support around the $3.6K threshold, with additional support levels found within the 0.5 ($3,066) and 0.618 ($2,870) Fibonacci levels, serving as potential zones for corrective moves.

Further analysis of the 4-hour chart confirms Ethereum’s mostly bullish sentiment and increased market confidence, which drove the price to the highest level since April 2022. This rise, accompanied by increased market volatility, reflects significant buying interest aimed at surpassing the notable resistance level of its ATH at $4.8K.

After a rejection at the significant resistance at $3.6K, Ethereum found support within critical regions marked by the 0.5 and 0.618 Fibonacci levels, leading to an immediate reversal. However, the price rose past $3.6K, supported by prevailing market demand, indicating the dominance of buyers in the market.

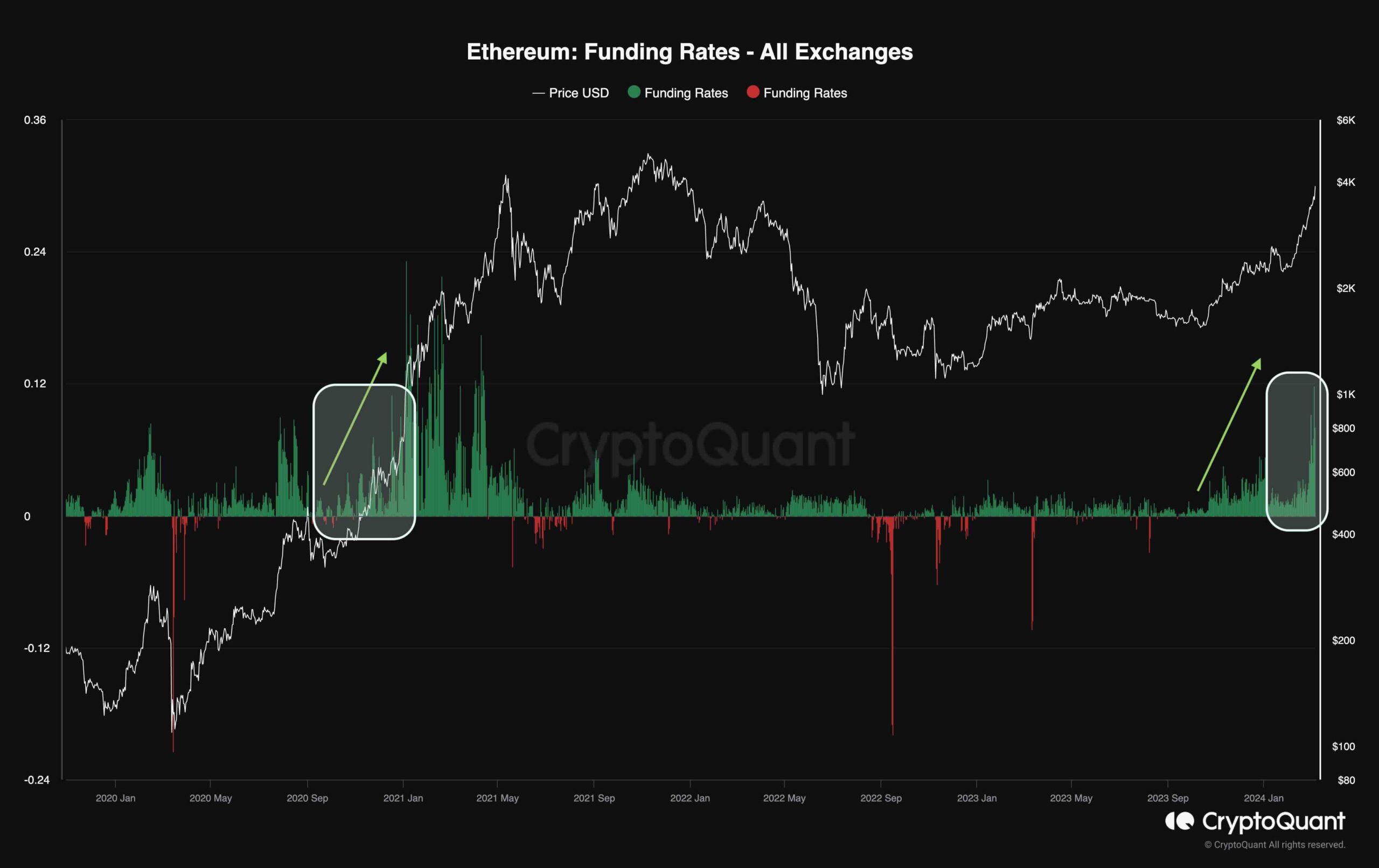

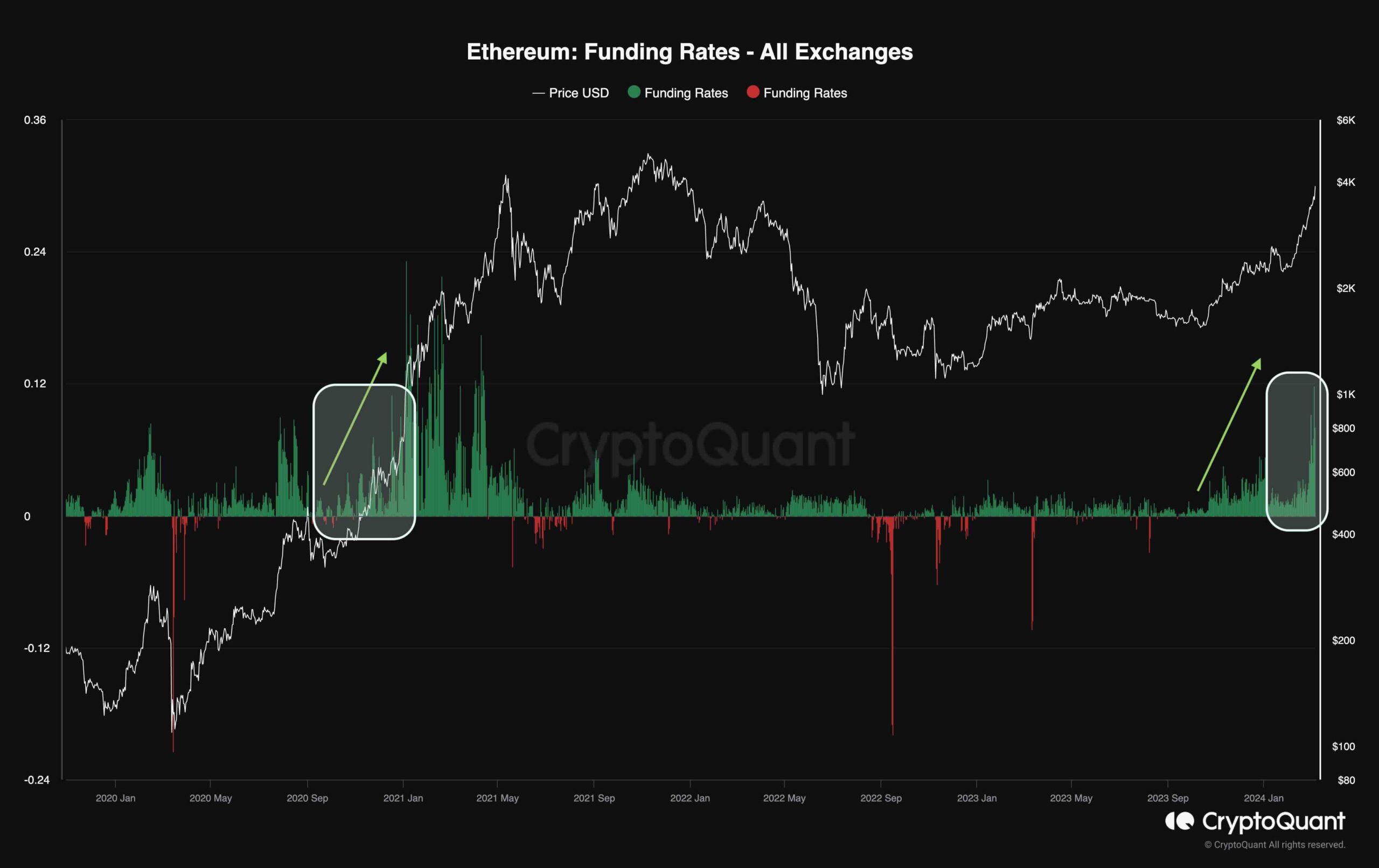

Ethereum’s Rising Funding Rates Indicate Bullish Sentiment

Ethereum’s recent rise highlights growing confidence among investors, supported by an increase in buying activity. A notable feature of this is the significant increase in funding rates within the futures market, indicative of bullish market sentiment that brings back memories of the late 2020 rally towards Ethereum’s all-time high. These increased funding rates indicate a strong bullish attitude among futures traders, which could pave the way for a continued uptrend.

Yet extremely high funding rates entail risks, such as the possibility of prolonged liquidation cascades that could increase market volatility and lead to unexpected corrections. Therefore, it is essential that traders closely monitor these rates and manage risks carefully.

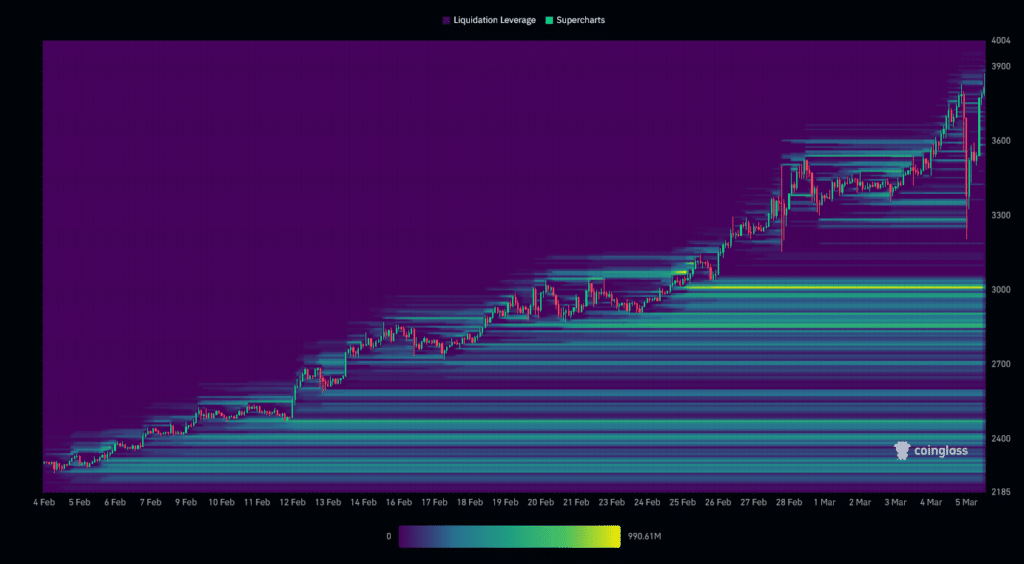

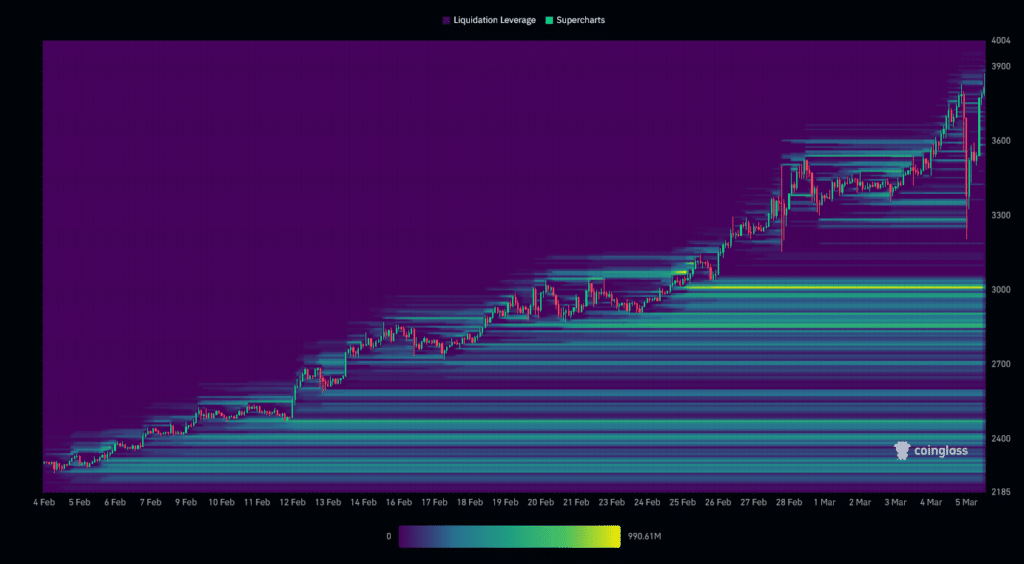

The volatility in the open interest of ETH/USDT perpetual contracts has fluctuated significantly, more so than the price of Ethereum itself, indicating a period of uncertainty among speculators. However, following a recent decline and decline in open interest and liquidations of long positions, a partial reopening of these positions has been observed, indicating renewed interest in Ethereum.

The liquidation heatmap over the past month shows that Ethereum has recently resisted a subtle liquidation zone around $3,300, with mostly buying interest contributing to ETH’s rise. With the key liquidation threshold below the current price around $3,000, impending moves towards these levels could trigger significant market activity, increasing the likelihood of increased volatility. So these zones are crucial for investors to keep an eye on.

Can Ethereum Reach $4,000?

With Ethereum’s recent performance fueling speculation about its ability to reach $4,000, much depends on the cryptocurrency’s ability to stay above $3,350. If this support holds, we can expect a bullish continuation towards $3,900 and possibly even $4,000.

Looking further, a break to $4,100 or even $4,500 would mean an upside of more than +17%. On the other hand, if Ethereum fails to hold above $3,350, a decline back to $3,000 could be in prospect, with further bearish moves towards $2,800, representing a decline of almost -25%.

Besides Ethereum, there are also other emerging coins that are attracting attention in the crypto world. These new players, still in the presale phase, offer investors the opportunity to get in early and potentially benefit from their enormous growth potential in this market.

Green Bitcoin (GBTC)

Green Bitcoin ($GBTC) is an innovative fusion of Bitcoin’s heritage and Ethereum’s environmentally conscious blockchain. The aim is to introduce a sustainable staking model called “Gamified Green Staking”, allowing investors to contribute to a greener future while generating passive income.

The $GBTC presale has already raised more than $2.1 million, demonstrating strong community and investor interest. At an attractive price of $0.6502, $GBTC offers an excellent opportunity for early investors looking to contribute to and benefit from a more environmentally friendly crypto market.

By participating in the presale via the official website, investors can not only invest in $GBTC but also benefit from a rewards system that provides additional tokens for staking and community involvement.

Bitcoin Minetrix (BTC.MTX)

Bitcoin Minetrix (BTC.MTX) has introduced a revolutionary approach for crypto investors who want to profit from Bitcoin mining without the need for proprietary mining hardware or extensive technical knowledge. This innovative concept revolves around their BTCMTX token, which operates on the Ethereum network.

A notable feature of Bitcoin Minetrix is its ‘Stake-to-Mine’ mechanism. By staking BTCMTX tokens, users can earn additional tokens and mining credits. These credits represent tokenized mining rights and can be exchanged for free hashing power to mine Bitcoin.

Stage 30 of #BitcoinMinetrix is live! 🚀

➡️ Only 10 stages left now! pic.twitter.com/R9xQWBsssA

— Bitcoinminetrix (@bitcoinminetrix) March 6, 2024

Investing in BTCMTX, currently priced at $0.0139 per token, is seen as an opportunity to benefit from both the growth of this particular token and confidence in the future of Bitcoin itself. This innovative model makes Bitcoin mining more accessible than ever before, leading to Bitcoin Minetrix raising over $11.8 million during its pre-sale.

eTukTuk (TUK)

eTukTuk reflects the growing interest in eco-friendly crypto projects that have a tangible impact on the real world. With more than $1,750,000 raised in its presale, the project underlines the potential of sustainable transportation in developing countries.

The project uses electric tuk-tuks, which emit less CO2 than traditional models, and aims to create a greener future for urban transport. In addition to producing environmentally friendly vehicles, eTukTuk aims to improve charging infrastructure and use blockchain technology for safety and efficiency.

📢📢 EXCITING ANNOUNCEMENT 📢📢

We are creating something really fun! 😍✨

Stay tuned for the big reveal! 🚀 pic.twitter.com/M9Icsg71AY

— eTukTuk (@eTukTukio) March 4, 2024

Furthermore, eTukTuk offers digital identities and financial services to underserved communities, giving it broader social utility. With staking rewards of up to 138% APY for the TUK token, eTukTuk offers investors an attractive opportunity.

The successful presale, with the current price of the TUK token at $0.02775, is quickly approaching its target, highlighting the strong potential and appeal of this innovative project.

Disclaimer: This article contains insights from independent authors and is not part of BitcoinMagazine.nl’s editorial content. This is not investment advice, please do your own research.

Source: https://bitcoinmagazine.nl/nieuws/ethereum-doorbreekt-weerstand-gaat-eth-stijgen-naar-4k