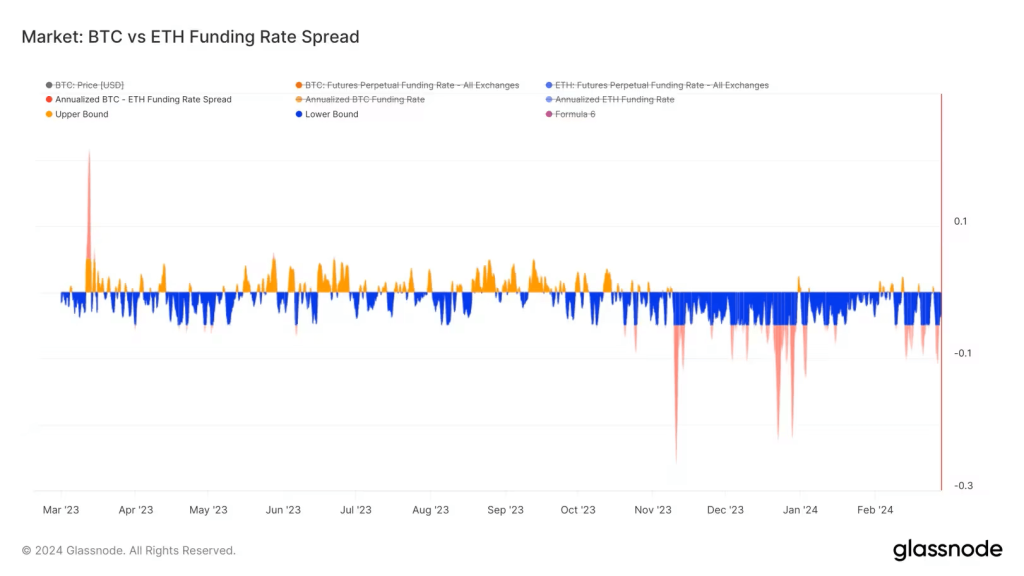

The falling bitcoin-ether spread is music to the ears of altcoin traders, Coindesk reported today. The funding rate spread has collapsed, indicating an increased willingness of traders to speculate further in this cryptocurrency.

Funding rate

The funding rate can be explained as the interest rate that is paid periodically between long and short positions. This mechanism ensures that the price of the futures contract matches the spot price. If the market price of the futures contract is above the spot price, it is the turn of the long positions to finance short positions. If the market price is below the spot price, the reverse applies: short positions finance the long positions.

For traders, the funding rate affects the costs of holding positions in perpetual futures. A positive funding rate means that long positions must pay for short positions and vice versa. This can impact trading strategies and profitability, especially for traders who hold large positions for extended periods.

More risk appetite

Data tracked by Glassnode shows that the spread recently collapsed to an annual level of -9%, a sign that investors are willing to pay more to take charged long or bullish bets in the ether perpetual futures market compared to bitcoin (BTC). In other words, risk appetite is increasing and investors are willing to put money into smaller and riskier altcoins, expecting to generate a big profit.

“The spread between BTC and ETH funding rates is widening. Before October 2023, a relatively neutral regime can be seen, with the spread oscillating between positive and negative states,” says Glassnode in their weekly newsletter. “But since the October rally, funding rates for ETH have been consistently higher than for BTC, indicating an increased willingness of traders to speculate further on the risk space,” Glassnode added.

Bitcoin is the world’s largest cryptocurrency by market value and the most liquid, with growing mainstream adoption. Ether, on the other hand, is considered the leader of the altcoins. Therefore, the price or funding rate difference in bitcoin and ether markets reflects broader risk sentiment, much like the AUD/JPY pair does in traditional markets.

Perpetuals or futures without an expiration date include a financing rate mechanism so that prices for perpetuals closely track spot prices. A positive funding rate means that leverage has tilted to the bullish side, and longs are willing to pay shorts to keep their bets open. A negative rate suggests the opposite.

The bitcoin-ether funding rate spread hovered between -3% (lower bound) and +3% (upper bound) through the first nine months of 2023. Since October, the spread has seen brief dips below -3% several times, indicating a preference for ether and the broader altcoin market.

Bitcoin’s share of the overall market, often called its dominance rate, has remained between 51% and 54% since early January, according to charting platform TradingView. The total crypto market capitalization has increased from approximately $1.7 trillion to $2.2 trillion over that period. Now that the price of bitcoin is rising sharply again, that percentage is increasing again.

Source: https://bitcoinmagazine.nl/nieuws/dalende-bitcoin-ether-spread-goed-nieuws-voor-altcoinhandelaren