For the first time since its launch in the United States, BlackRock’s iShares Bitcoin Trust (IBIT) experienced a day without financial inflows. This marks a striking development in the dynamics of Bitcoin exchange-traded funds (ETFs).

An end to the growth streak

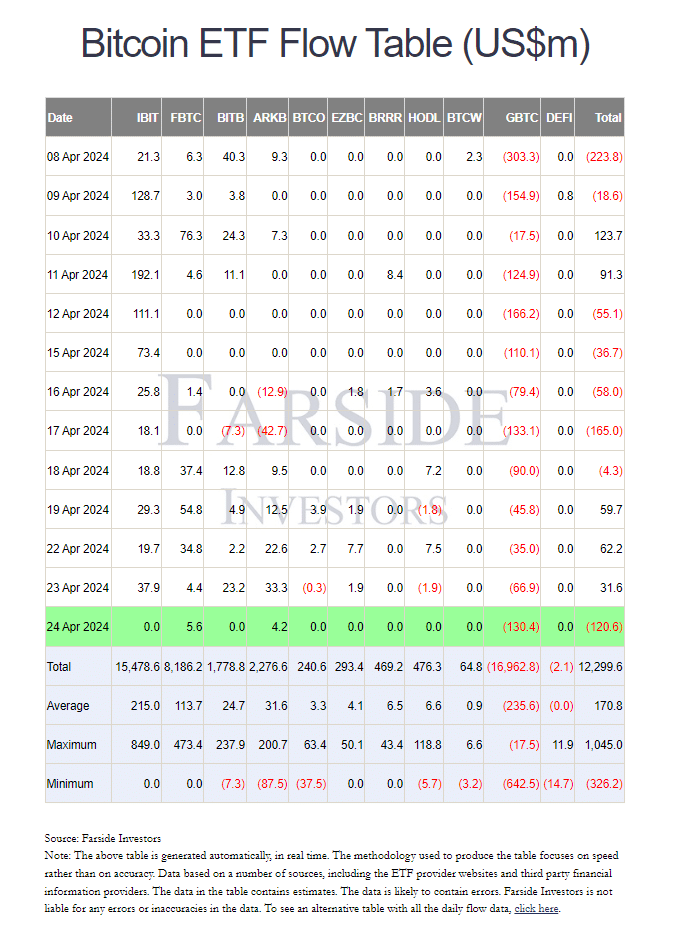

Since launching on January 11, IBIT has consistently attracted millions of dollars per day in investments, totaling nearly $15.5 billion within 71 days. However, this steady flow of investments came to a halt on April 24, when no new inflows were recorded. This is a rare occurrence for IBIT, but it is not unique within the industry. Other participants in the Bitcoin ETF market, including the Fidelity Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB), still saw inflows, $5.6 million and $4.2 million respectively.

Challenges and future prospects

At the same time, the Grayscale Bitcoin Trust ETF (GBTC) continues to record outflows. On the same day as IBIT’s shutdown, GBTC recorded outflows of $130.4 million. As a result, there was a net outflow of $120.6 million from spot Bitcoin ETFs.

To date, the US Bitcoin ETF market has raised a net $12.3 billion worth of Bitcoin. However, GBTC’s outflows have offset some of the inflows realized by the other nine Bitcoin ETFs.

Regulatory developments

Furthermore, some market participants are in the process of applying for Ether (ETH) ETFs in the United States. However, the Securities and Exchange Commission (SEC) recently postponed approval decisions for several of these applications. The SEC has indicated that it needs more time to consider the changes, extending the decision on the conversion of Grayscale’s ETH Trust to a spot ETH exchange-traded product on NYSE Arca by 60 days until June 23.

This recent phenomenon of a day without new inflows and the ongoing regulatory developments underline the volatility and complexity of the cryptocurrency investment market. Investors and market observers remain alert to further developments within this rapidly evolving sector.

Source: https://bitcoinmagazine.nl/nieuws/eerste-dag-zonder-instroom-voor-blackrocks-bitcoin-etf