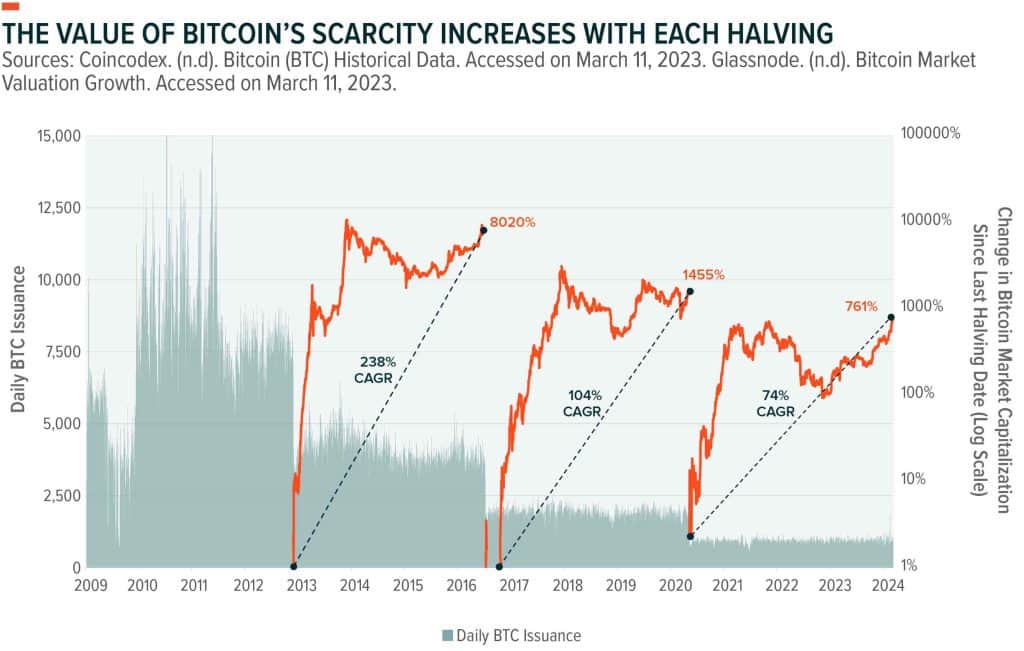

Since its introduction, Bitcoin has shown a number of notable trends that are often linked to so-called Halving events. These are times when the reward for mining Bitcoin halves, which happens about every four years.

These events have a significant impact on the price and overall dynamics of the crypto market.

Pattern of spikes after the halving

Historically, Bitcoin reached new highs a significant period after each halving. For example:

– In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving.

– In the more recent 2019-2021 cycle, this was 546 days after the halving.

This data suggests a pattern where the Bull Market peak occurs between 518 and 546 days after the halving. If this pattern continues, the next peak in the cycle could occur sometime in mid-September or mid-October 2025.

Current acceleration and consolidation

Currently, Bitcoin appears to be about 220 days ahead of the traditional schedule in this cycle. This means that any period of consolidation after the halving is potentially beneficial to resynchronize the cycle with the previous halving cycle. A longer consolidation period could therefore contribute to more predictable and stable growth, in line with historical trends.

The impact of the halving on Bitcoin is significant and remains an important indicator for market analysts and investors. Recognizing these patterns provides valuable insights that can help make informed investment decisions in the future.

As the crypto market continues to evolve, it remains important to monitor this cycle and analyze how it relates to other economic and technological developments within the sector.

Source: https://bitcoinmagazine.nl/nieuws/hoe-beinvloedt-de-bitcoin-halving-de-cryptomarkt