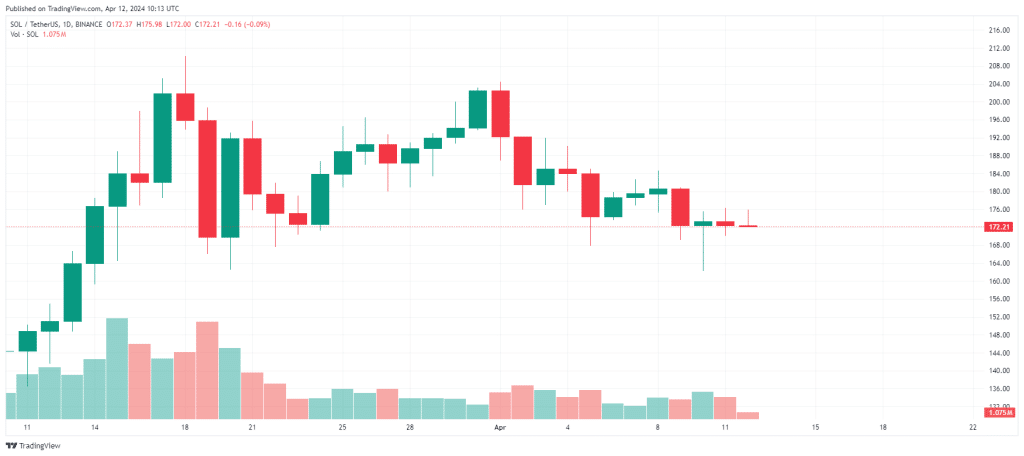

Solana has recently received a lot of attention from investors and analysts. From below $22 to a six-month high of $210 and a current trading price of $150.147, which represents an increase of almost 700%, raises questions about the sustainability of this price rally. Despite this impressive growth, Solana remains 50% away from its November 2021 high of $260. The consolidation over the past four weeks signals a cooling off period. Understanding the underlying fundamentals is crucial for future market prospects.

Jamie Coutts, chief crypto analyst at Real Vision, notes that while Solana’s performance has declined over the past month, it is still the best performing network over the past 12-18 months. Solana’s recent price adjustment appears abrupt, but is in line with fundamental indicators that point to a stabilizing value proposition.

While #Solana‘s outperformance has waned in the past month, it is still the best-performing network in the past 12–18 months by a country mile. Do the fundamentals justify the outperformance, or is it just a result of market hype and speculation?

🧵on Solana’s network health and…— Jamie Coutts CMT (@Jamie1Coutts) April 12, 2024

Solana’s daily active users have increased by more than 400% in the last nine months, placing the network in an exclusive group with more than 1 million daily users. Despite not reaching its 2021 peak DAUs, which may have been increased by synthetic activity linked to the FTX exchange, the nature of involvement in Solana has evolved.

“The ecosystem is maturing; the engagement we see today is fundamentally different—more diverse and significantly more integrated with real-world applications,” said Coutts.

Sectors such as artificial intelligence, decentralized finance, consumer applications, and the emerging markets of memecoins and NFTs are contributing to this growth.

With a significant pullback from its peak price in 2021, Solana’s market cap has nevertheless reached new highs this cycle, indicating a broadening of its investment base and a revaluation of its value. The “Network Value to User” (NVU) ratio ranges between 50-100, reflecting balanced growth-to-value dynamics compared to other networks where speculative value often exceeds user growth.

One of the standout metrics for Solana this cycle is fee revenue, which increased sixfold in a nine-month period. Daily fees now average $1.8 million, a forty-fold increase. This increase is largely attributable to the increasing use of the network in various applications.

Future prospects and economic indicators

Although Solana lags behind Ethereum in terms of total number of dApps, its economic indicators are robust. With 134 dApps, compared to Ethereum’s 2,702, the cash flow intensity of Solana’s dApps is surpassed only by Ethereum’s, indicating high monetization capacity per application. “Solana’s smaller, yet more powerful suite of applications drives economic efficiencies that rival even the largest networks,” said Coutts.

Despite the speculative components associated with memecoins and airdrops driving some of the transaction volume, Solana’s custom fee growth metric isolates and highlights real economic activity. With an astonishing real fee growth rate of 3,259.7%, Solana leads all networks in this metric.

“While some underlying activities may be transient, the intense and growing use of Solana’s blockchain is irrefutable evidence of its utility and viability,” Coutts concludes.

As Solana continues to develop and expand, fundamental analysis underlines a network that not only maintains robust health and economic strength, but is also poised for future growth. This paints a picture of a blockchain platform that, despite market volatilities, remains a leading player in the crypto landscape, backed by strong fundamentals and promising growth metrics.

Source: https://bitcoinmagazine.nl/nieuws/solanas-toekomst-een-analyse-van-prestaties-en-potentieel