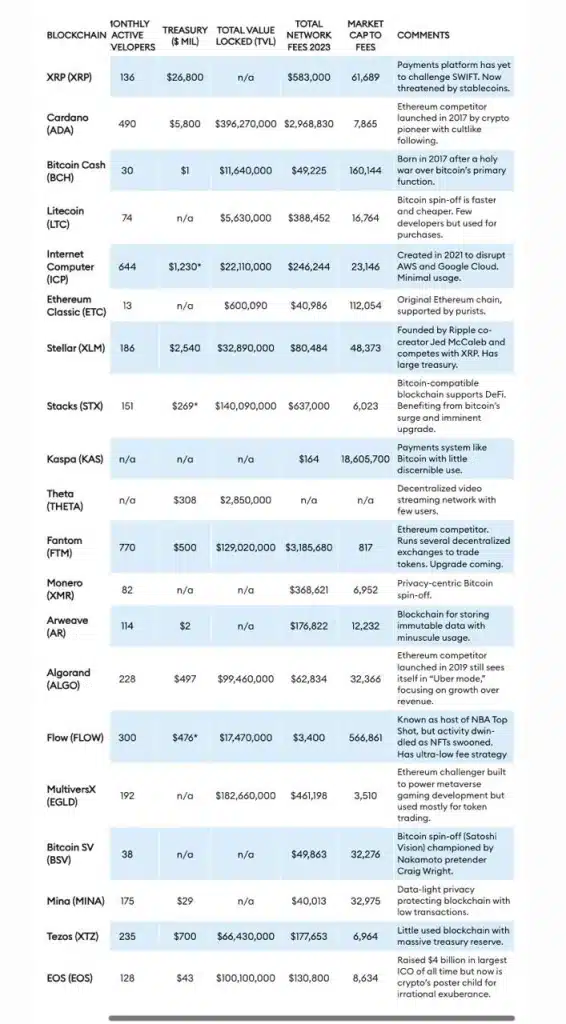

Crypto now has more than 14,000 tokens and a total market value of $2.4 trillion. Yet more does not always mean better. Forbes has identified a group of 20 crypto projects that they call ‘zombie blockchains’. These projects have high market valuations, but show little to no practicality or user adoption. But which projects are on this list?

Well-known names among the zombie blockchains according to Forbes

Examples of these so-called zombie blockchains are ripple (XRP), cardano (ADA), litecoin (LTC), bitcoin cash (BCH), and ethereum classic (ETC). Despite their high market values, these tokens have often not achieved the technological or practical goals they intended.

They survive and sometimes even become financially successful, more through speculative trading and significant initial financing than through actual performance.

Ripple: an example of a zombie blockchain

Take for example Ripple’s XRP, originally designed to challenge the swift banking network by enabling fast and cheap international bank transfers. However, it has not disrupted Swift and is now mainly dependent on speculative trading for its high market value. Forbes describes XRP as “mostly useless” despite being the sixth most valuable cryptocurrency.

The problem of underutilized hard forks

Hard forks such as Litecoin, Bitcoin Cash, Bitcoin SV, and Ethereum Classic, each valued at more than $1 billion, are also rarely used for practical applications. They serve more as speculative investments than as functional tools.

Ethereum killers and their challenges

Furthermore, Forbes points to tokens known as ‘ethereum killers’, such as Tezos (XTZ), Algorand (ALGO), and Cardano (ADA). Despite their technological advances and substantial valuations, these tokens have struggled to find mainstream adoption or developer engagement.

Cardano, for example, was launched after a disagreement between co-founder Charles Hoskinson and Ethereum co-founder Vitalik Buterin.

Forbes also highlights the lack of governance and financial accountability mechanisms within these blockchain entities. They operate without regulatory oversight or obligations to shareholders, making it difficult to assess their viability or financial health. Ethereum classic is an example of this; despite active trading, it has suffered major security breaches.

Source: https://bitcoinmagazine.nl/nieuws/forbes-cryptocurrencies-geen-waarde