The bitcoin halving will take place next week. This event, which takes place every four years, has an impact on the activity of bitcoin miners. It can also influence the price of the queen of cryptos.

Approximately every four years, the halving constitutes a major event for bitcoin miners, those who provide computer processors to operate the main virtual currency. This phenomenon corresponds to a halving (“halving” in English) of the reward they receive for contributing to the management of transactions carried out in this cryptocurrency. Estimates suggest the next one will take place shortly after mid-April.

How are miners rewarded?

To function, the Bitcoin infrastructure needs computing power, and individuals and companies called “miners” provide it, using powerful machines. To reward miners, the system creates new bitcoins, which it distributes to the person who validated a “block” of data, containing the last transactions carried out. In order to choose the user who will have this validation privilege, a computer puzzle is posed. The machine solving it obtains the right to validate the block and therefore receive the bitcoins as a reward.

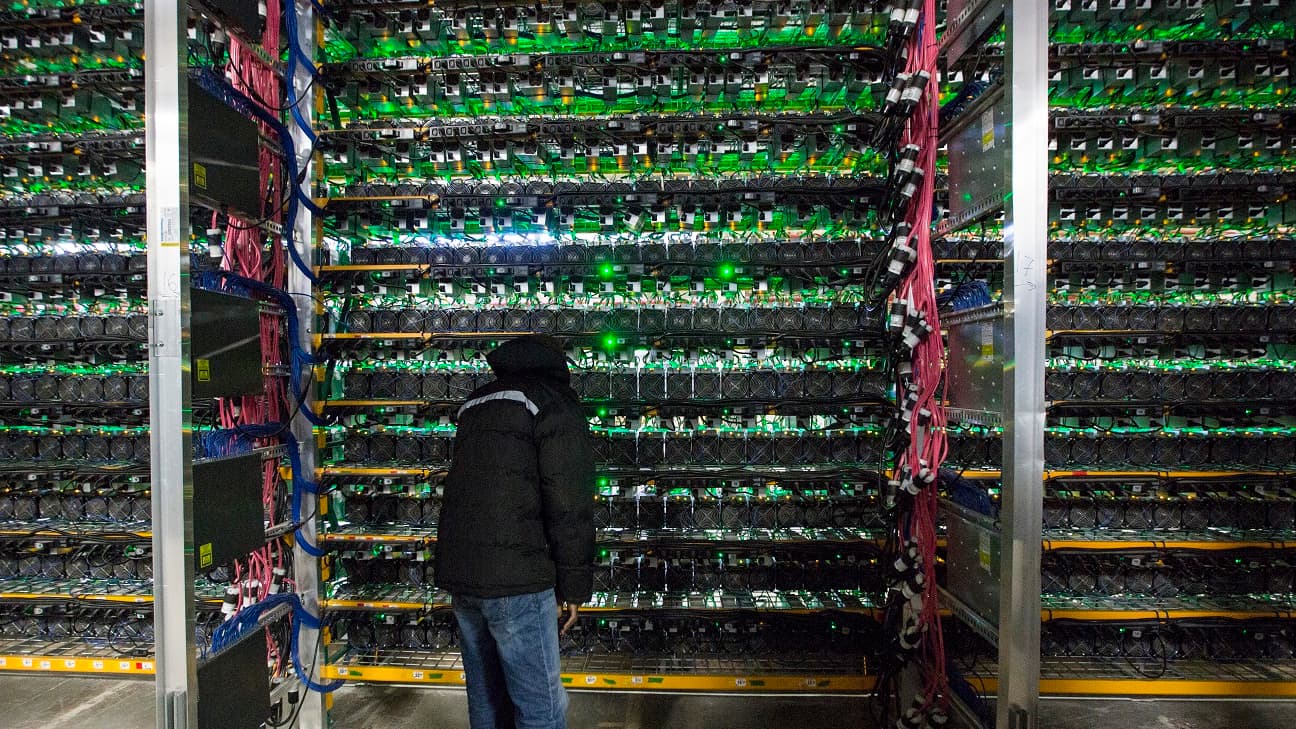

Many miners, to maximize their chances, operate in a cooperative, or “pool”, and share the profits. Companies specializing in bitcoin mining have also developed over the years: they often operate through huge centers that consume large amounts of electricity to power and cool the computers, which represents a considerable cost on top of the equipment. The bitcoin computer program adapts the difficulty of the puzzle to be solved to the number of miners, so that a block of transactions is approved approximately every ten minutes.

Originally, the reward was 50 bitcoins. It successively decreased during the first three “halvings”, November 28, 2012, July 9, 2016 and May 11, 2020, to currently reach 6.25 bitcoins. It is expected to rise to 3,125 bitcoins next week, for the next four years.

Why reduce the reward?

When it was launched in 2009, bitcoin was intended to go against the grain of traditional currencies, accused of losing their value over time, due to the unlimited power of monetary creation available to central banks. Satoshi Nakamoto, the creator of bitcoin whose true identity remains a mystery, set the maximum number of bitcoins in circulation at 21 million units and chose a decreasing rate of issue.

The protocol is designed in such a way that the reward granted for validating a block is reduced by half every 210,000 blocks. At the rate of one block validated every 10 minutes, a “halving” takes place at the end of a period of just under four years.

Note that when we add the reward of 50 bitcoins, plus 25, plus 12.5, plus 6.25, etc. We are gradually approaching 100. And 100 multiplied by 210,000 (the number of blocks giving rise to a reward level before the halving), equals 21 million! Or the total mass of bitcoins expected in the long term. This level should be reached by 2040.

What impact on courses?

In theory, none, because if the supply of new bitcoins will be reduced, this was foreseen from the creation of the cryptocurrency. In a perfectly rational market, this “halving” should therefore surprise no one and be already integrated into prices. Nevertheless, empirically, progressive but clear increases were observed before and after the previous halving episodes, in 2012, in 2016 and in 2020.

After the 2020 episode, the price of bitcoin increased almost eight-fold, going from around $9,000 upstream to a peak of $69,000 in November 2021. This time, the price of bitcoin jumped ahead of the event. The digital token, whose price is highly volatile, reached an all-time high of $73,797.98 in March. Other factors contributed to this jump, starting with the launch on the American markets of a new investment product which tracks the price of bitcoin.

Source: https://www.bfmtv.com/crypto/bitcoin/quel-impact-aura-le-halving-sur-le-cours-du-bitcoin-en-2024_AD-202404110417.html