First of all, we would like to thank Fortune favors the Brave for this Bitcoin analysis. Don’t forget to follow them on Discord by clicking here or follow them on print here!

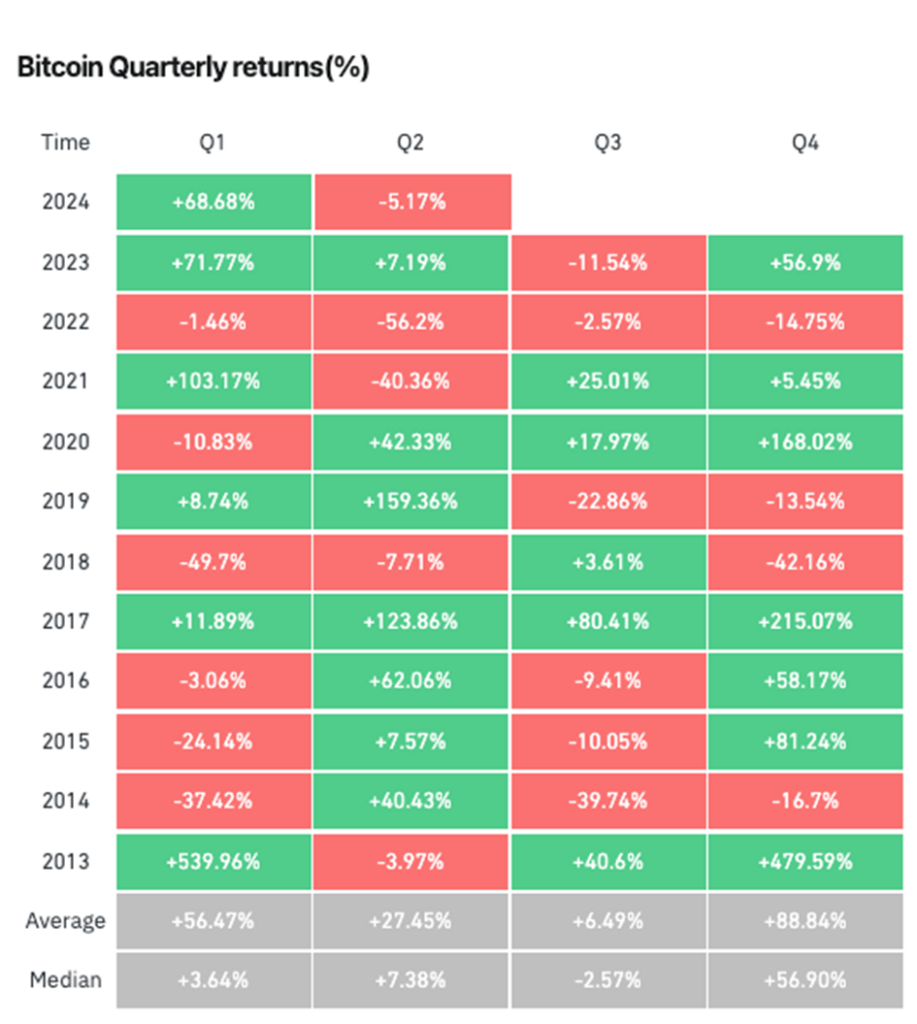

Statistically, Bitcoin (BTC) achieves an average return of +0.24% in June. There are many arguments that summer is often long and slow because people enjoy summer and are therefore less active in the markets. First, let’s look at June in previous bull runs.

Here are all the Junes in bull runs. It is difficult to determine whether we will now see a long-winded and sideways summer, because we have never been this high (besides ATH) just before summer. In addition, this is also a cycle in which a lot has changed, such as the introduction of ETFs and institutional money, fortunately they never go on summer holidays :). Let’s take a look at the data available.

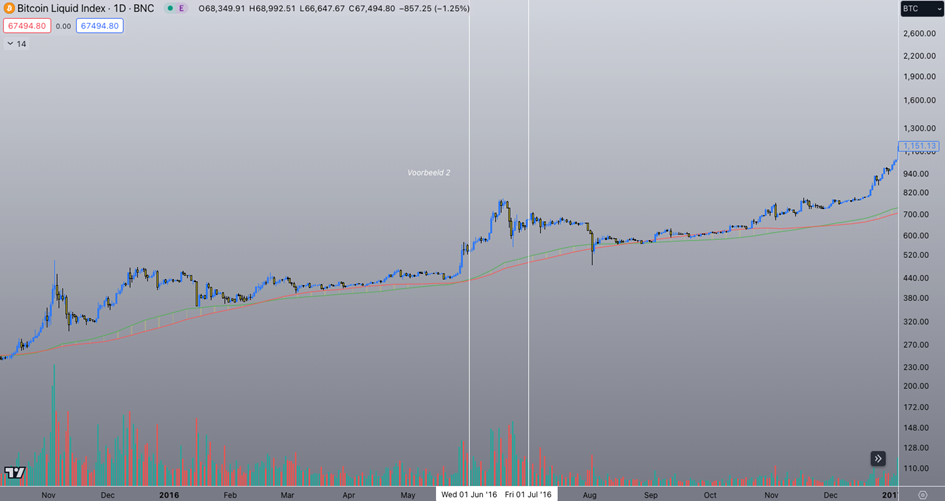

We’re also in an election year, so let’s take a look at Junes in election years. In 2020 we saw a decrease of -3.18% in June, while 2016 saw an increase of +27.14% and 2012 approximately +27% in June.

We are almost ending Q2, and previous bull run quarters are showing remarkably good results. In the 2012 bull run we saw a return of +112%, although this was in the early days of Bitcoin when high percentages were easier to achieve. In 2013 we saw +40%, in the peak of the 2017 bull run we saw +80% and in 2020 we saw +18%. Very good figures if you ask me and perhaps we can correct the current figures with the month of June.

Similar behavior in previous bull runs

One thing I’ve mentioned before is that I think we’re further along in the cycle than people think. If we overlay the previous cycle on this one, you can see that we are in the same period in terms of time as the correction marked in white. What’s striking is that we’re seeing the same behaviors now as we were then, just before we saw the last big leg up/altseason, both on-chain and off-chain. For example, we recently saw the explosion of Gamestop again, comparable to the previous cycle before we saw the expansion in altcoins.

Celebrities and crypto: Market trends and insights

In 2017, we saw several celebrities start promoting crypto projects, especially in September. This led to a strong upward movement that ended in the bull market peak of December 2017, followed by the bear market of 2018.

Something similar happened in 2021, twice: first in February and later in October-November. Both times we saw a final upward move followed by a significant correction.

What we can take from this, and what you often see in financial markets, is that the same phenomena come back before you see a similar result again, just like the ‘buy the rumor, sell the news’ phenomenon. It remains to be seen whether we will see the result of the last major leg up again, but we have this data.

Post-halving dump

Another point that we can take into account when talking about phenomena is the typical ‘post halving dump’. Considering this, we saw it in May too: the dump from 73K to 56K and what you typically see after this dump is the next leg up.

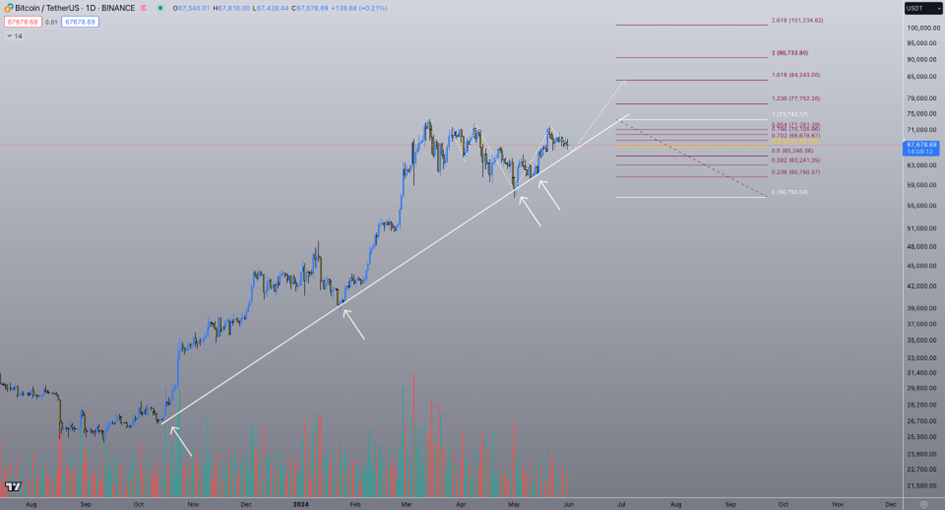

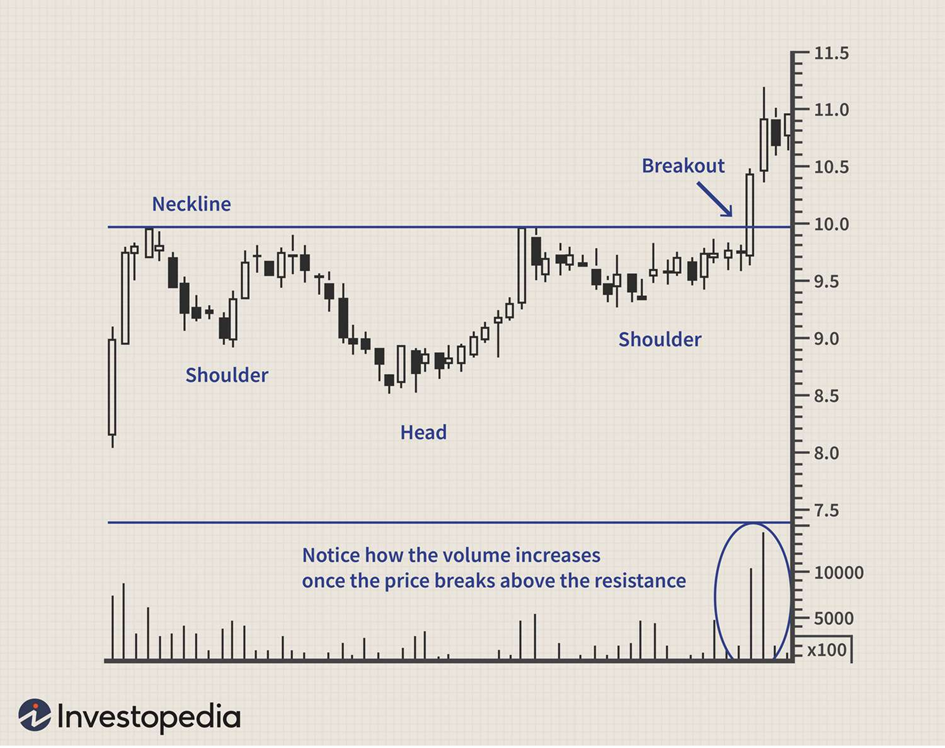

Bullish case juni

The Bullish Case for June is that we will test the trend line from October 2023 to now again, in the form of a right shoulder of the inverse head and shoulders pattern. This means that we are currently finishing the right shoulder, which has the potential to fall to the trend line. We test this successfully and then we start the next leg up.

This Bullish Case also includes the expectation that we will reach a new all-time high and that we will move towards 1,618 fib, which could take us to approximately 84K.

Bearish case juni

We are also currently sitting on a key horizontal support close to the diagonal support. The bearish case becomes current if we lose both of these. Then we could just drop towards 60K and retest the bull market support band, which is slowly grinding upwards, so it is a little higher every week.

As I have mentioned before, the electricity costs of the miners are also around 60K. Ultimately, should we move in that direction, I don’t expect us to close below this value on high timeframes. So, if we fall there, I see that as a good buying opportunity.

Thoughts/conclusion

In general, the market still looks very good. When in doubt, zoom out. The all-time high is now around 74K and we are currently around 67K. We have not lost any major support yet and are above the electricity costs of the miners. All we have left to do is break all-time highs. Given history, we see that once we significantly break the all-time high, in our case now through 74K, we will lose bitcoin dominance and altcoins can finally see that expansion and shoot into an altseason.

Disclaimer: The analyzes above are based on technical patterns and trends in the crypto market. It is critical to emphasize that this information is not intended as financial advice. Cryptocurrency investments inherently involve risk and are subject to volatility. Before making investment decisions, it is recommended to do your own research, seek financial advice and only invest what you can afford to lose.

Would you like to receive more updates like this? Then join the Discord via this link and receive a week for free! If you are interested in a free week, send (Santino) a message in the Discord.

Why join us?

📈 Current Market Analysis: From technical analysis to fundamental insights – we provide in-depth analysis to help you better understand what’s going on in the crypto markets.

💬 Interactive Discussions: Ask questions, share your ideas, and learn from others in our lively discussions and Q&A sessions.

🚀 Promising Developments: Discover new altcoins, identify emerging trends and find potential profitable opportunities.

📚 Educational Content: Learn from educational resources, video updates and guidance from experienced members to improve your crypto knowledge and trading skills.

Our goal is to create a community driven by the desire to learn, grow, and succeed in the ever-changing world of crypto.

Join Fortune Favors the Brave today and start your journey to growing your crypto profits and refining your trading strategies. Together we explore the opportunities in the crypto world and build a strong, profitable future. We look forward to seeing you in our community or follow us on X by print here!

Source: https://cryptobenelux.com/2024/06/03/wat-gaat-bitcoin-deze-maand-doen-kunnen-we-spanning-verwachten/