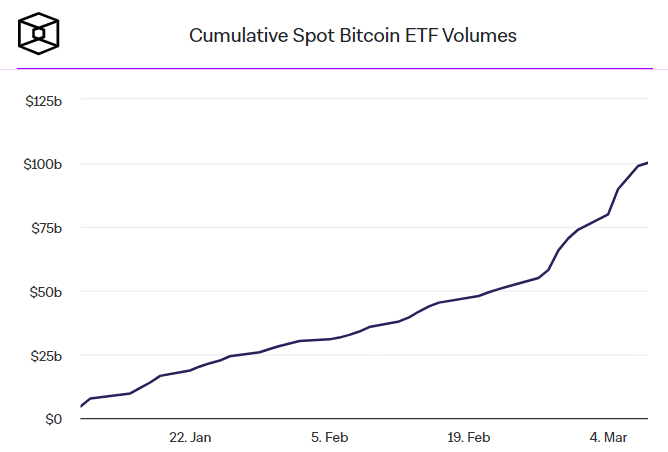

Following the launch of US spot bitcoin ETFs in January, funds are off to a flying start. On Friday, cryptocurrency-based financial instruments reached the cumulative trading volume of $100 billion.

Data from Yahoo Finance shows how it took the new ETFs about a month to reach a cumulative trading volume of $50 billion. Then the second half only lasted two weeks.

Last Monday, the ETFs alone recorded a daily trading volume of almost $10 billion. Last week was also a record, as cumulative trading volumes for the spot bitcoin ETFs totaled $22.3 billion.

As the demand for bitcoin ETFs increases, it also causes the bitcoin price to rise. The bitcoin price shot past $70,000 for the first time in history.

Overall, the three most popular ETFs by volume are BlackRock, Fidelity, and Grayscale. But be careful: the first two create buying pressure, while the GBTC fund mainly creates selling pressure.

On Tuesday, BlackRock’s iShares fund posted a new record for daily inflows of $788.3 million. In other words, almost $800 million net has been invested in bitcoin by the company’s customers. Other spot bitcoin ETFs launched include Bitwise, Ark 21Shares, Invesco, VanEck, Valkyrie, Franklin Templeton and WisdomTree.

Earlier this week, Nate Geraci, president of The ETF Store, tried to put recent events into perspective.

“A wild statistic. Total inflows into nine new spot bitcoin ETFs in the past two months exceed total inflows into all physical gold ETFs in the past five years.”

Source: https://bitcoinmagazine.nl/nieuws/bitcoin-etfs-in-twee-maanden-al-goed-voor-100-miljard-aan-volume