The bitcoin price has shot past the $70,000 level again and it appears that the bullish momentum is cautiously returning. Can we now prepare for a potential new all-time high? According to the analysts at AMB Crypto, a rise to the $75,000 level is in the cards for bitcoin.

Bitcoin is holding its own

Over the past seven days, Bitcoin is up about 5 percent, which is a relief from the massive drop we experienced from the all-time high of March 14.

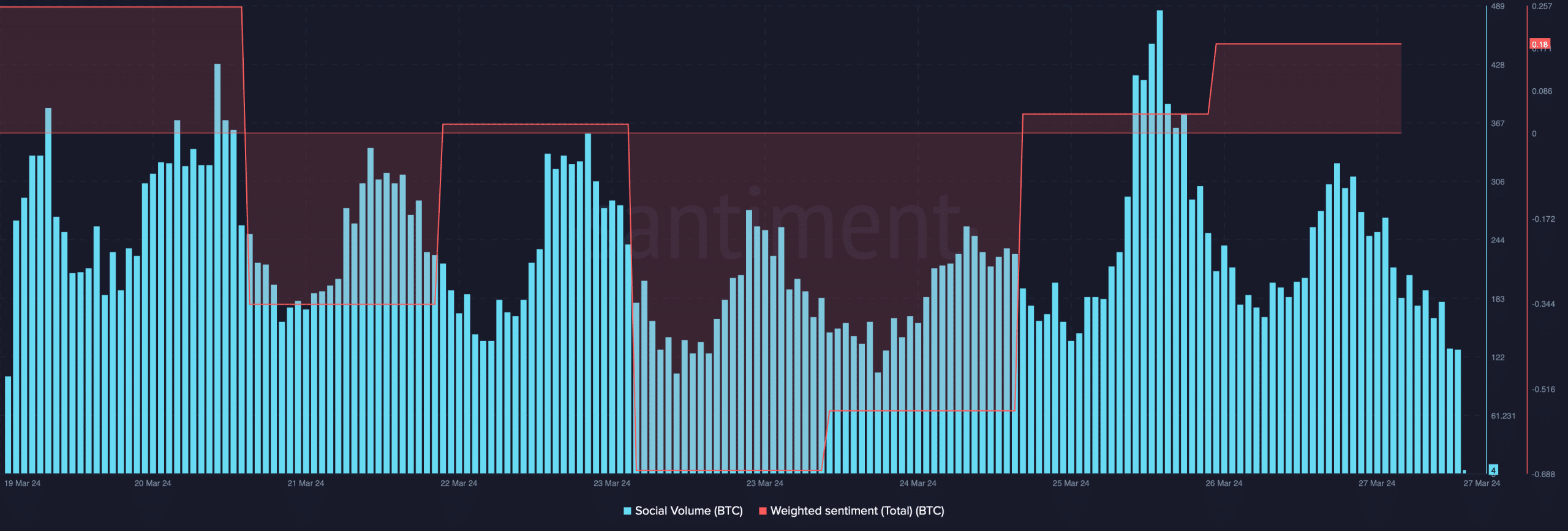

Santiment’s sentiment indicator above shows that investors are looking positively at bitcoin again. Furthermore, data from CryptoQuant shows that the number of bitcoins on the exchanges is in a downward trend, which is a positive signal for the future.

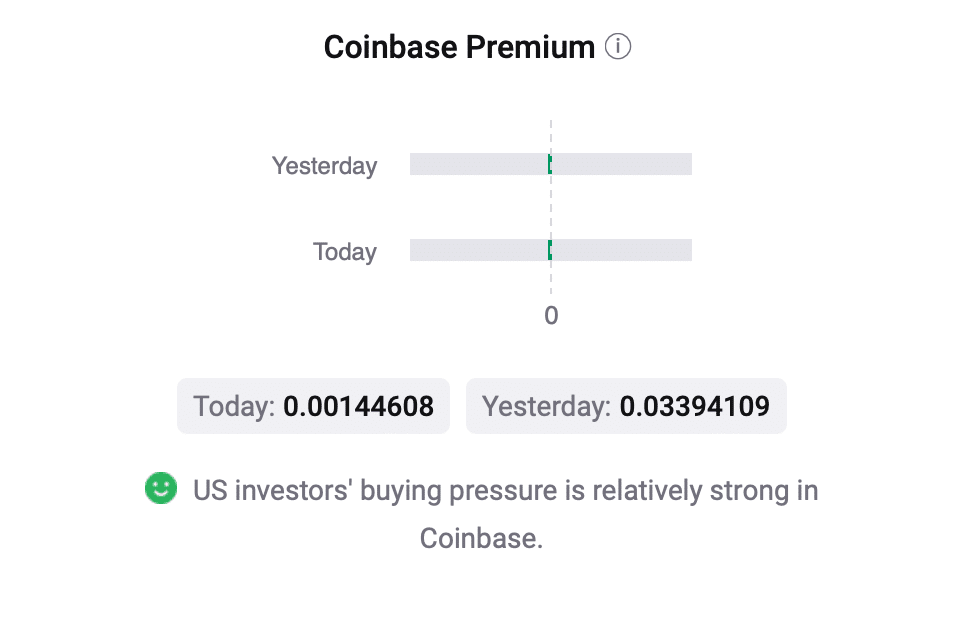

Sentiment is currently high, especially in the United States, as is evident from the so-called Coinbase Premium.

We speak of a Coinbase Premium if bitcoin is more expensive on the American stock exchange than on Binance’s competition. This is usually the case when more purchases are made from America, pushing up the price on Coinbase compared to that on Binance.

Derivatives market is also bullish on bitcoin

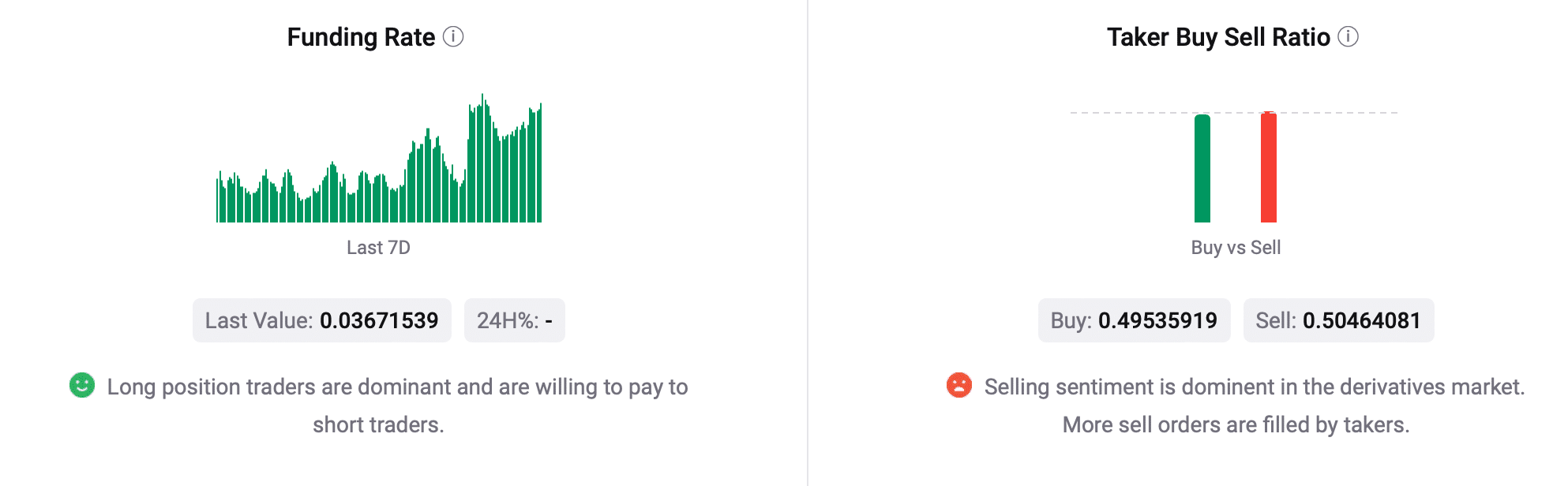

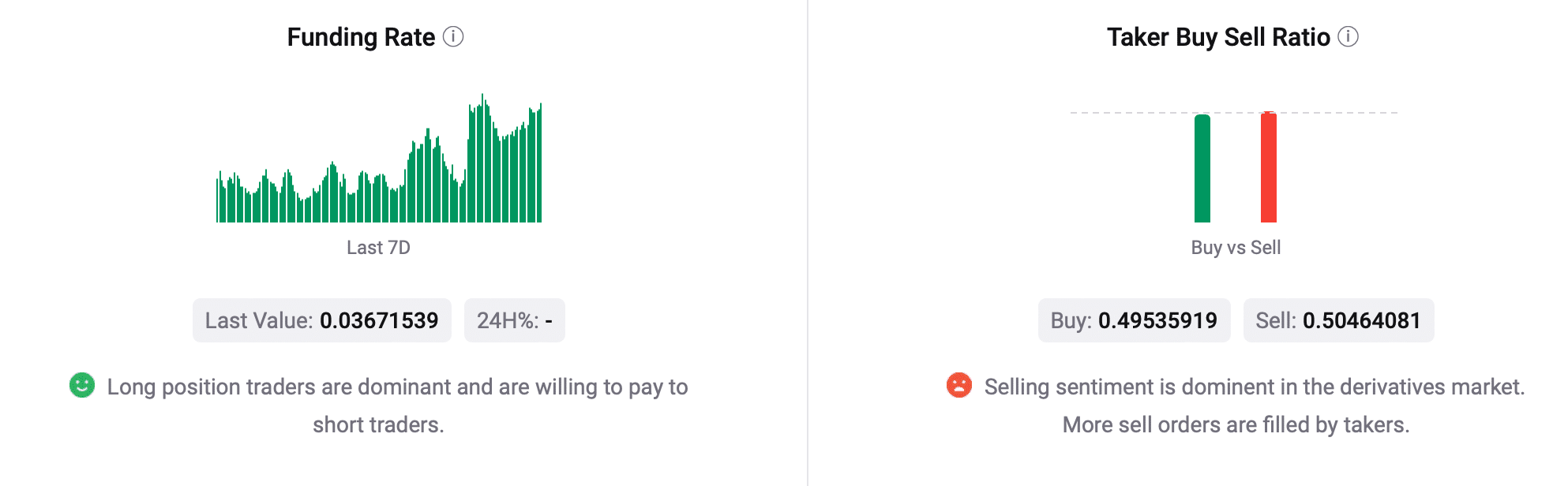

Investors in the derivatives market are also currently bullish about the bitcoin price. This is evident from, among other things, the Funding Rate, which is currently relatively high.

A high Funding Rate means that investors are willing to pay a lot to open leveraged long positions on bitcoin. In principle, it can also be a bullish signal, because these types of “heated” situations continue as long as prices rise.

For the time being, apart from the correction from 73,800 to 61,000 dollars, bitcoin has not seen any major corrections during this bull run. Every correction is bought up very quickly. Bitcoin is currently back at $70,600 and it seems possible to launch another attack on the all-time high.

Source: https://bitcoinmagazine.nl/nieuws/is-de-bitcoin-koers-op-weg-naar-het-niveau-van-75-000