Research by Multiscope from 2023 shows: almost 2 million Dutch people, 14% of the population, own cryptocurrency. According to the research agency, more than one million owners have been added since the previous survey in 2018. This can also be partly attributed to the 2021 bull market during the corona period and the current rally is certainly helping.

Bitcoin most popular

Of the 1.9 million Dutch crypto investors, 70% are men, with a strong representation in the 18 to 34 age group. These investors are also more highly educated.

Bitcoin dominates among Dutch investors, with more than 1.2 million owners over the age of 18. However, the number of owners has fallen slightly from 1.25 million in 2022 to 1.23 million in 2023. That equates to 8% of Dutch people. The top five also consists of ethereum (6%), cardano (4%), ripple (3%) and dogecoin (2%), the coin that has been so hyped by Elon Musk.

Average investment

Additional research by the Netherlands Authority for the Financial Markets (AFM) among 800 crypto owners aged 16 and older shows that the average crypto investment in the Netherlands is under 1,000 euros. This consumer research shows that most owners are between 25 and 45 years old and that the majority are men. Investments above 10,000 euros rarely occur.

- Young people (16-24 years) take more financial risks with crypto, which leads to financial problems in the event of sudden market downturns.

- There is less risk among crypto owners between the ages of 45 and 54.

- This risk manifests itself in a greater willingness to invest with leverage. 1 in 5 young people would sometimes use this, the average for all age groups is 1 in 10.

The aforementioned research by Multiscope shows that the majority use their checking or savings account to purchase cryptos. Women use savings accounts relatively more. Only 2 percent of respondents use borrowed money to buy crypto coins.

How do people respond to the current price increase?

The recent rapid rise of bitcoin to a new peak of over 67,000 euros surprised many investors, according to the recent update of Multiscope’s Cryptocurrency Monitor. The research agency interviewed more than four thousand Dutch people for this purpose.

85% of investors hold crypto for the long term, despite historical value corrections of up to 80%. In the survey, 72 percent of crypto owners predicted that bitcoin will rise in the next five years. On average, a price increase of no less than 75% was expected. But bitcoin has achieved an increase of as much as 140% since June 2023, starting from 25,000 euros in June 2023 and 60,000 euros in March 2024.

Desired return: 735%

Multiscope’s research also shows that more than two-thirds (67%) of crypto owners plan to hold their cryptocurrency for as long as possible without a specific exit point. In 2022, that percentage was still 75%.

The remaining 33% of crypto owners sell their cryptos at an average return of no less than 735%. In 2022, they wanted to achieve a return of more than 1,000% before exiting. How the investment portfolio is handled differs per age group.

- Young people (18 to 34 years old) sell their portfolio at an average return of 177%

- While 35 to 49 year olds only do this with a return of 1,515%. The latter group wants by far the highest return.

- People over 50 aim for a return of 775%.

The researchers draw the conclusion that 85% are long-term owners of crypto coins and hold on to their holdings for a long time. They save cryptocurrencies to make long-term returns. A relatively small group (10%) sees crypto coins as a future means of payment. Approximately five percent can be characterized as traders, they trade daily to make a return.

From the various studies we can conclude that bitcoin and crypto coins are here to stay in the Dutch investment landscape. Bitcoin is here to stay.

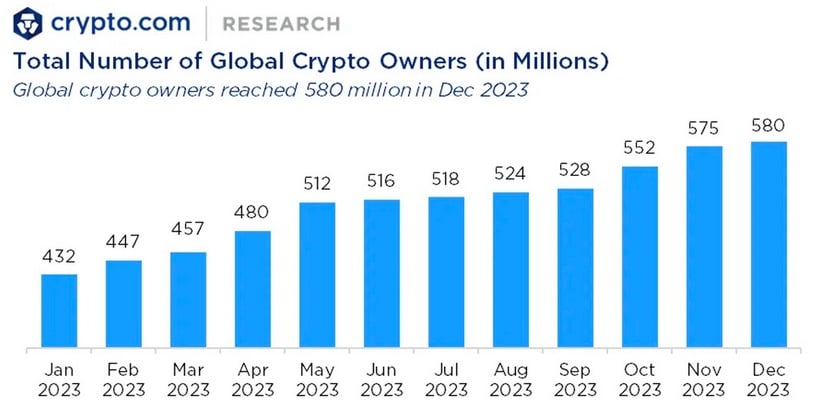

580 million people worldwide

What are the numbers worldwide? According to Crypto.com, at least 580 million people worldwide own cryptocurrencies, underlined by its growing institutionalization. In Europe, cryptos will be regulated assets as of 2024, in America bitcoin funds (exchange traded funds, ETFs) have been for sale since January this year, which are in great demand at large asset managers such as Blackrock and Fidelity. At the same time, protocols such as bitcoin and ethereum continue to take technological steps in their development.

Armed with the latest insights from the Dutch crypto market, consider acting now. Whether your goal is to start investing, expand your existing portfolio, or simply stay up to date with the latest trends in crypto, it all starts with education and information. Explore our extensive guides, follow our socials or discuss your plans with acquaintances or advisors.

Bitcoin halving

Also read our page with all the ins & outs about the upcoming bitcoin halving!

Source: https://bitcoinmagazine.nl/nieuws/bijna-2-miljoen-nederlanders-investeren-in-cryptocurrency-aangetrokken-door-recente-prijsstijgingen