First of all, we would like to thank Fortune favors the Brave for this Bitcoin analysis. Don’t forget to follow them on Discord by clicking here or follow them on print here!

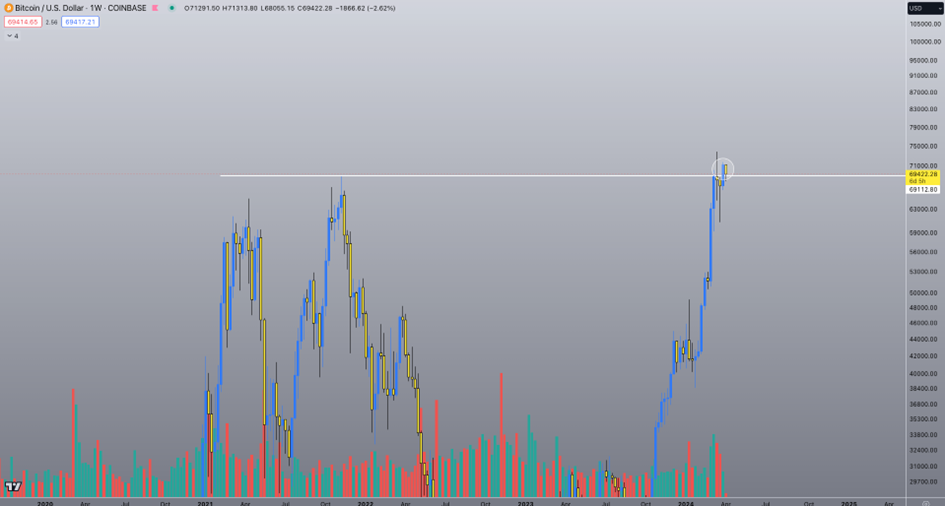

New month, April is just around the corner – what awaits us? For starters, we ended March on an all-time high, with the highest body candle close ever and an impressive run of no less than 6 green months. On top of that, we also closed the highest weekly candle ever – two strong points to start April with.

What can we expect from April?

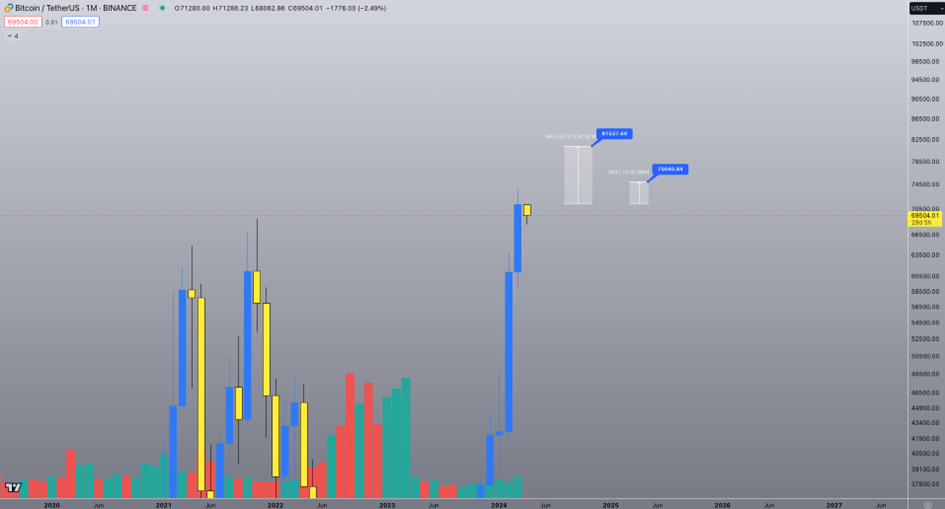

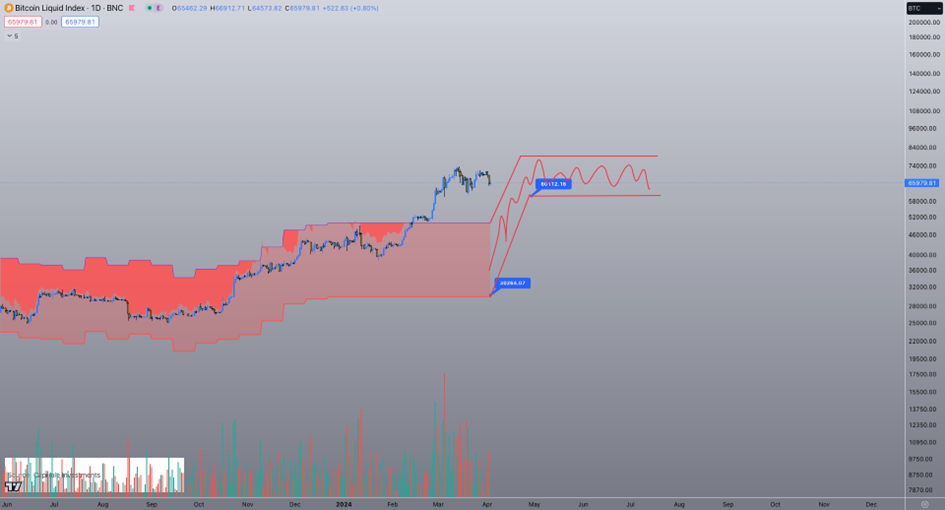

If we go back in history, April appears to be a favorable month, with an average return of 13.94% and a median of 5.04%. If we follow this trend, the average could lead us to $81,000, while the median reads $75,000.

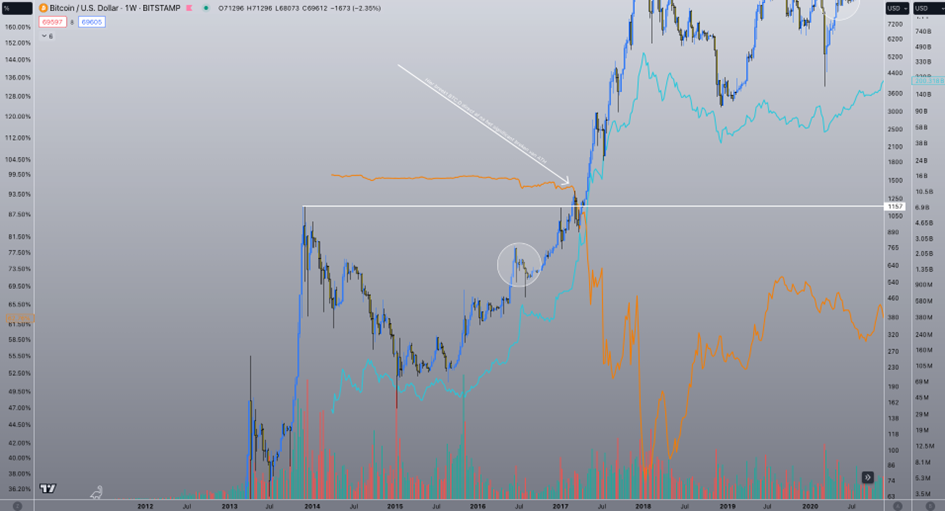

The main focus is on significantly breaking the All-Time High (ATH), decreasing the dominance of Bitcoin (BTC.D). We are at a crucial juncture where BTC.D could breakout or decline, and we have two data points from the previous two cycles to base on.

Cycle 2: In this cycle, BTC.D first broke out and then declined, after which an altseason period began.

Cycle 1: BTC.D immediately decreased, after which the altseason started immediately. (This is the current situation)

The halving is also scheduled for April, and just before this event we usually see a ‘pre-halving dump’.

- Cycle 1: 25% correction

- Cycle 2: 28% correction

- Cycle 3: 18% correction

We have already seen a correction of 17%, so if we average 23%, we would still have 6% to go. This could bring the price to $56,000.

Where can we fall in April?

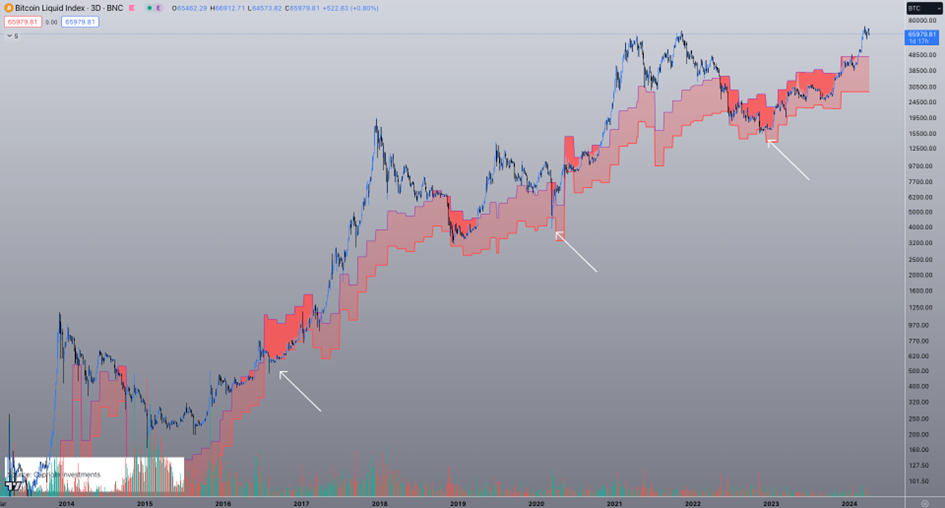

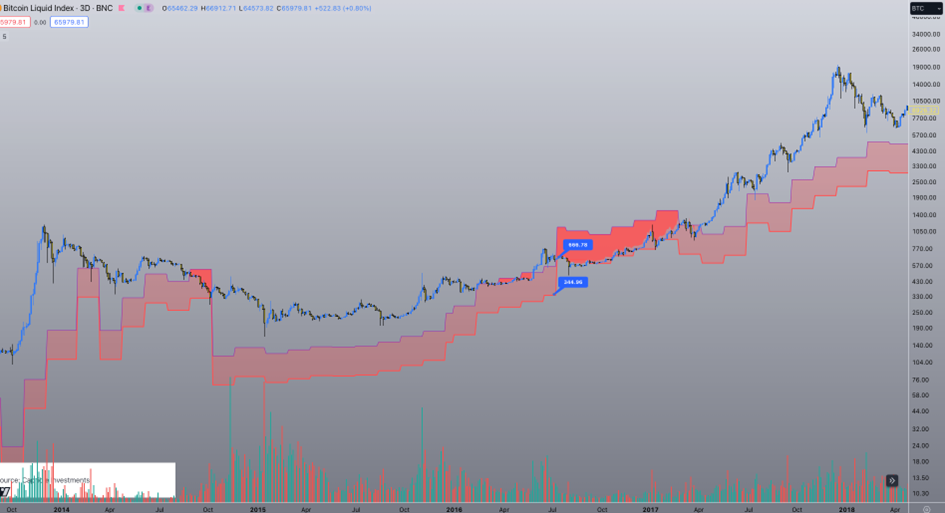

If you look closely at the halvings, which are marked with the white arrows, you will notice that there is a significant shift in the indicator. This happens when the costs are doubled.

Let’s take a look at the ‘Bitcoin Production Cost’ indicator. This indicator has historically always provided support throughout BTC’s history. There have been only a few cases where the price fell slightly, but never significantly. The halving literally halves the costs for miners, meaning that the support line (the thick red line) currently at $30,000 will be doubled to $60,000.

The conclusion of this is that we can indeed fall below 60,000 dollars just before the halving, but not after the halving if we can maintain this.

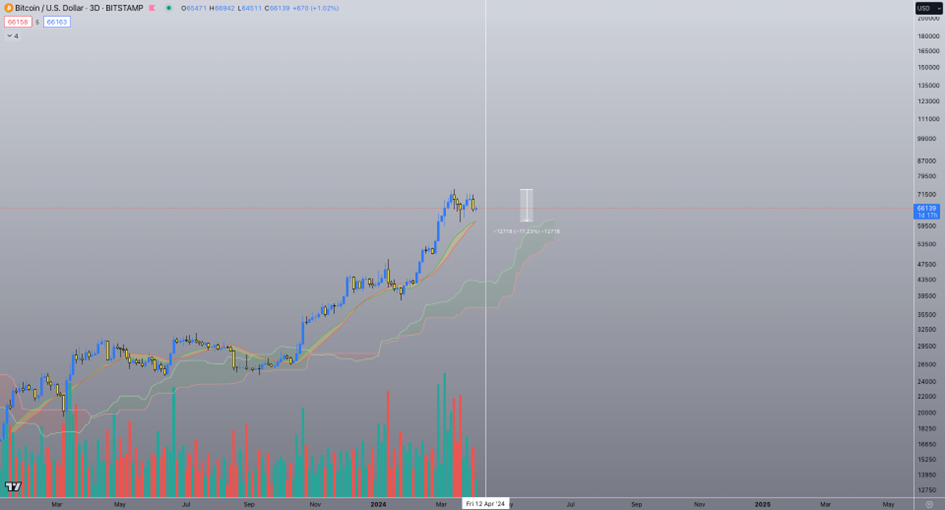

The halving is currently scheduled for 15 days.

Let’s take a look at the bullish scenario for BTC.

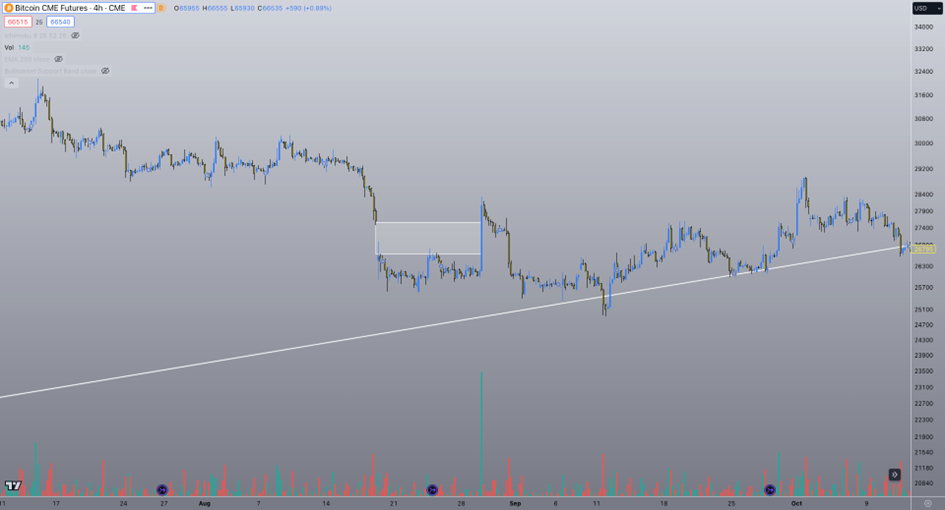

Gaps can arise on CME futures. The price of CME futures closes on Friday and opens again on Monday, while the price of BTC continues as usual throughout the weekend. This can cause gaps in the price. Typically, the price has to move back to fill the gap and then the trend continues. Although price gaps are filled 9 times out of 10, this is not a guarantee as there are a few gaps in BTC’s history that have not been filled. The advantage at this point is that the end of the gap is at $63,000 and we have already filled part of the price.

I don’t expect the price to drop much further than $60,000 to $63,000 dollars, after which we will continue the trend again. My initial price target remains $80,000 for BTC.

Remember, if you want to invest even more, these types of corrections/buy the dips are ultimate opportunities to buy coins even lower before we continue with the uptrend.

Disclaimer: The analyzes above are based on technical patterns and trends in the crypto market. It is critical to emphasize that this information is not intended as financial advice. Cryptocurrency investments inherently involve risk and are subject to volatility. Before making investment decisions, it is recommended that you do your own research, seek financial advice and only invest what you can afford to lose.

Would you like to receive more updates like this? Then join the Discord via this link and receive a week for free! If you are interested in a free week, send (Santino) a message in the Discord.

Why join us?

📈 Current Market Analysis: From technical analysis to fundamental insights – we provide in-depth analysis to help you better understand what’s going on in the crypto markets.

💬 Interactive Discussions: Ask questions, share your ideas, and learn from others in our lively discussions and Q&A sessions.

🚀 Promising Developments: Discover new altcoins, identify emerging trends and find potential profitable opportunities.

📚 Educational Content: Learn from educational resources, video updates and guidance from experienced members to improve your crypto knowledge and trading skills.

Our goal is to create a community driven by the desire to learn, grow, and succeed in the ever-changing world of crypto.

Join Fortune Favors the Brave today and start your journey to growing your crypto profits and refining your trading strategies. Together we explore the opportunities in the crypto world and build a strong, profitable future. We look forward to seeing you in our community or follow us on X by print here!

Source: https://cryptobenelux.com/2024/04/05/nog-maar-een-paar-weken-voor-de-bitcoin-halvering-wat-kunnen-we-verwachten/