According to the CEO of investment firm VanEck, Jan van Eck, Ethereum ETFs will be disapproved by the US Securities and Exchange Commission (SEC) in May. The SEC is yet to give away anything about current crypto ETF applications and Van Eck’s insights shed light on the regulatory hurdles facing the crypto sector. Will Ethereum continue to rise with the prevailing skepticism surrounding the approval of spot ETH ETFs?

Rejection of Ethereum ETFs?

In an interview with CNBC on April 9, Jan van Eck delivered sad news for Ethereum ETF proponents. He stated that his company’s spot Ethereum ETF application is “likely to be rejected.”

The United States Securities and Exchange Commission’s (SEC) wait-and-see approach to applications for Ethereum ETFs marks a period of uncertainty. VanEck, along with Cathie Wood’s ARK Invest, are among the first parties to file for spot Ethereum ETFs in the United States. A decisive ruling from the SEC is expected on May 23 and 24.

In stark contrast to its approach to applications for Bitcoin crypto ETFs, the SEC appears reluctant to work with investment firms to reach a consensus on spot Ethereum ETFs. The lack of direct communication and feedback from the SEC is raising concerns within the cryptocurrency sector. As a result of this uncertainty, VanEck expresses skepticism about the chances of their application being approved.

This situation underlines the current challenges and navigating regulatory uncertainties for companies seeking innovation and adoption of crypto-related financial products in the market. The wait for the SEC’s final decision not only impacts the parties involved, but also reflects the broader issues surrounding regulation and acceptance of cryptocurrencies as legitimate financial instruments.

Yeah our odds of eth ETF approval by May deadline are down to 35%. I get all the reasons they SHOULD approve it (and we personally believe they should) but all the signs/sources that were making us bullish 2.5mo out for btc spot are not there this time. Note: 35% isn’t 0%, still… https://t.co/QWQOGZjDC5

— Eric Balchunas (@EricBalchunas) March 11, 2024

The SEC’s prevailing “radio silence” has fueled doubts among analysts and experts. Senior Bloomberg ETF analyst Eric Balchunas puts the chance of approval at 35%, while he previously estimated the chance at 70%. James Seyffart, fellow ETF analyst, is also concerned and said it lack of comment or interaction from the SEC is a negative indicator.

Concerns about Proof-of-Stake

The big difference between the crypto ETFs that the SEC is struggling with is the consensus mechanism of the well-known crypto coins. While the Proof-of-Work (PoW) protocol has been accepted by the SEC, Ethereum’s Proof-of-Stake (PoS) mechanism adds a layer of complexity to the approval of Ethereum ETFs.

Unlike Bitcoin miners, who use computing power to mine new blocks, Ethereum users participate in the Proof of Stake (PoS) system by staking their tokens. Through this effort, they contribute to the validation of the network and receive rewards in return. Jean-Marie Mognetti, CEO of CoinShares, expresses her skepticism regarding the approval of Ethereum ETFs. Her comment reads: “I don’t expect any approval this side of the year.”

This methodology of network validation through the PoS system marks a fundamental shift in the way consensus is achieved within blockchain networks, offering a more energy-efficient alternative compared to the Proof of Work (PoW) system used by Bitcoin.

Mognetti’s comments reflect the general caution and challenges associated with integrating cryptocurrency-based financial products within traditional financial markets. The reluctance of regulators such as the SEC to quickly greenlight new financial products such as Ethereum ETFs highlights the need for careful consideration of the complex implications these products can have on both the crypto and traditional financial markets.

This situation offers an intriguing perspective on the future of cryptocurrency investments and the continued development of the regulations needed to accommodate this new form of financial instruments. It also illustrates the need for patience and perseverance from the crypto community and investors looking forward to broader adoption and integration of digital currencies into the global financial landscape.

Promising altcoins amid rejection of Ethereum ETFs

With the deprecation of the Ethereum ETFs, which is expected to take place at the end of May, Ethereum could fall despite the current bull market. Investors may therefore be looking for promising altcoins that can deliver significant returns in the short term. Below we will discuss three promising altcoins.

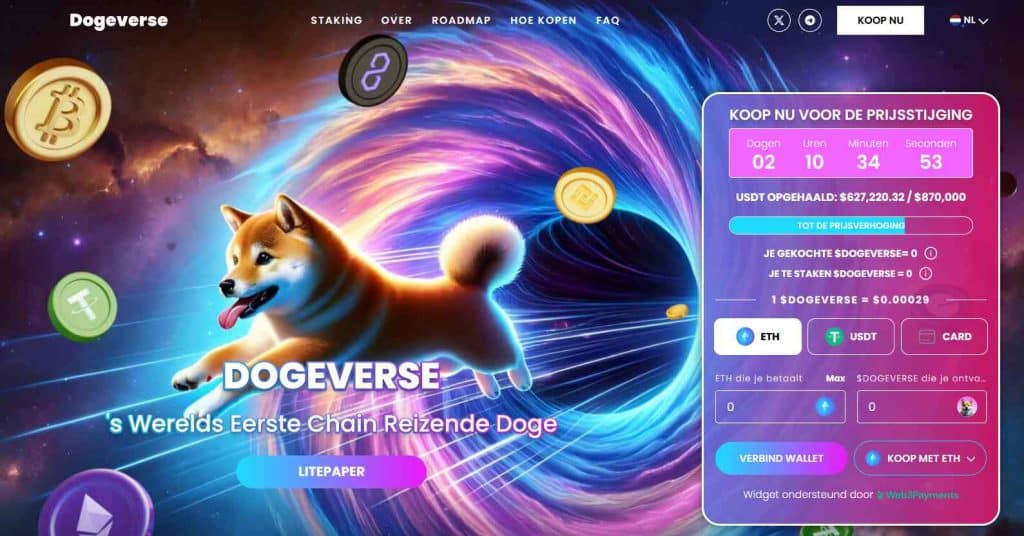

Dogeverse – The World’s First Multi-Chain Doge

With Dogeverse ($DOGEVERSE) you dive into the world of Cosmo, the first Chain Traveling Doge. This brand new meme coin will be available on various blockchains, such as Ethereum, Polygon, Avalanche, BNB Chain, Solana and Base. This allows Cosmo to enjoy all the benefits, such as high transaction speeds and low fees, while avoiding all the disadvantages.

The project also offers high staking returns of up to 1314% per year currently. However, this percentage will decrease as more and more users stake their tokens. Of the 200 billion tokens, 10% is reserved for staking. All other tokens are used to develop and grow the project. In this way, Dogeverse hopes to build a strong community across multiple blockchains.

eTukTuk – green cryptocurrency with a mission

eTukTuk ($TUK) is a sustainable crypto project that aims to change the way of transportation in developing countries. It does this by introducing its own electric TukTuk. This is not only sustainable, but also local and easy to produce. In many African and Asian countries, the TukTuk is the main means of transport.

eTukTuk will install charging stations in these countries, starting from Colombo in Sri Lanka. Drivers will then have to pay less to charge than they would traditionally have to pay in fuel costs. A percentage of the paid charging costs ends up with $TUK stakers, so that you as a user benefit from a greener Sri Lanka.

5th Scape – complete Virtual Reality ecosystem

For fans of Virtual Reality gaming, 5th Scape ($5SCAPE) is the ideal project. The project wants to build an entire VR and AR ecosystem on the blockchain. The team develops immersive VR games and experiences. 5th Scape also markets various items, such as ergonomic gaming chairs and high-quality headsets.

Users will be able to develop their own games on 5th Scape via the Developer Center. For this, users are rewarded with $5SCAPE tokens. The community therefore consists of driven people who shape the future of VR and AR.

Users can take out subscriptions that give them access to all features on the platform. As a result, the liquidity pool is constantly replenished. Furthermore, users can stake $5SCAPE tokens for additional rewards.

Disclaimer: This article contains insights from independent authors and is not part of BitcoinMagazine.nl’s editorial content. This is not investment advice, please do your own research.

Source: https://bitcoinmagazine.nl/nieuws/van-eck-ceo-verwacht-afkeuring-eth-crypto-etf-door-sec-gaat-ethereum-nog-stijgen